韩国潮牌Mardi Mercredi关闭中国所有线下门店,入华仅三年事件的关键信息。

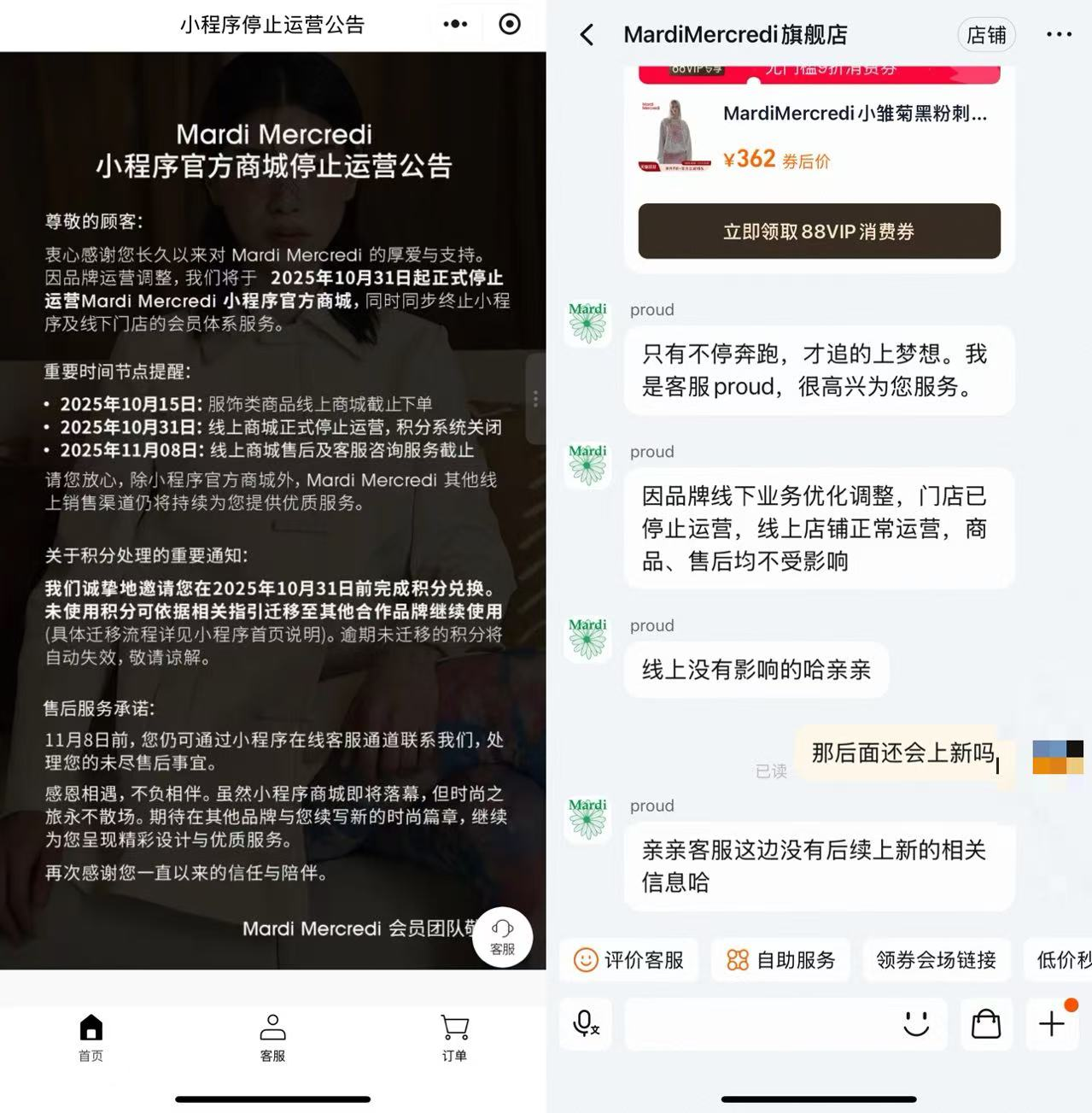

1. 品牌门店全停:Mardi Mercredi已关闭所有线下门店,品牌小程序官方商城自10月31日起停运,会员服务终止,但天猫旗舰店仍正常运营,商品和售后不受影响。

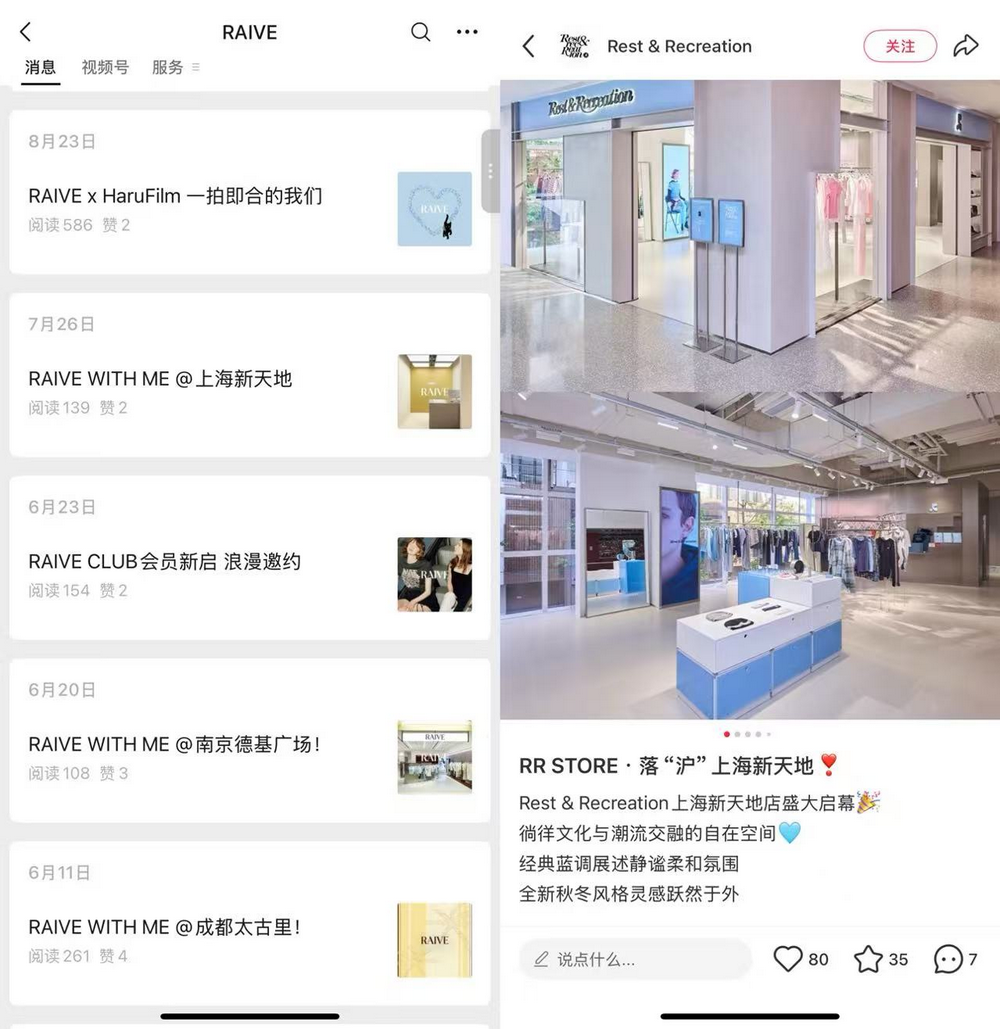

2. 闭店原因与后续:代理商曼多亚称因经营调整部分门店,2024年假货泛滥或加速形象下滑,品牌转向新品牌Raive和Rest&Recreation扩张,新店沿用原址开业。

3. 实操观察:Mardi通过明星私服和社交网络短期走红,2022年入华线上起家,2023年扩张30多家门店却快速收缩,提醒消费群体注意线上渠道和真伪鉴别。

该事件展示潮牌潮起潮落常态,持久品牌力挑战大,新动向如Raive和Rest&Recreation正试水门店,可作为潮流跟踪点。

Mardi Mercredi事件对品牌营销和消费趋势的启示。

1. 品牌营销路径:依赖明星私服和社交网络快速走红,如Mardi靠小雏菊和腊肠狗设计获热度,但假货泛滥加速形象损毁,揭示高曝光下品牌保护的重要性。

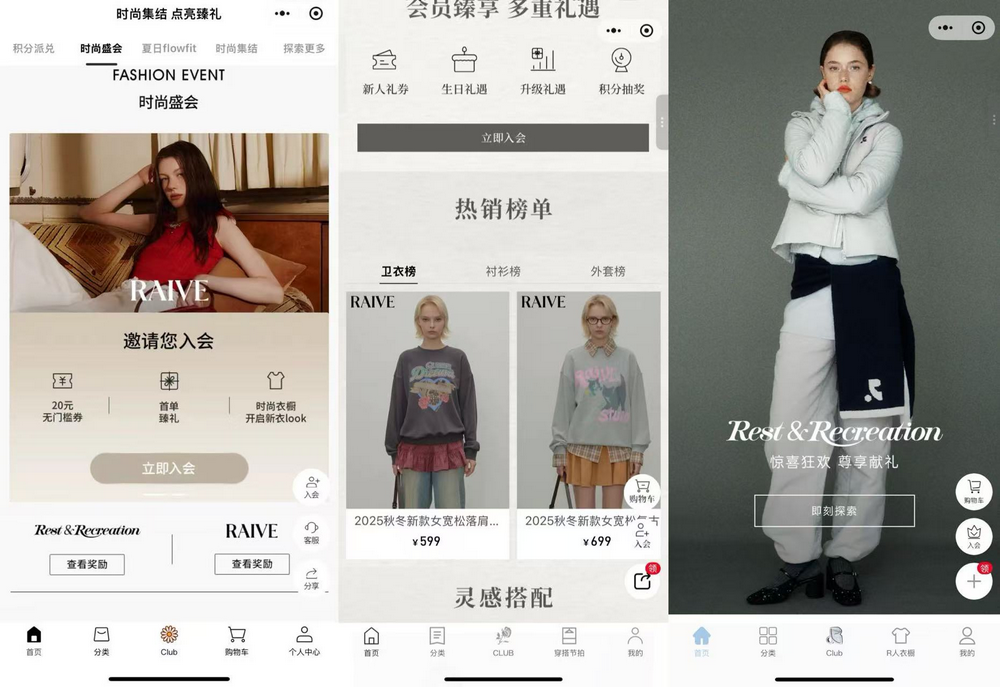

2. 消费趋势变化:韩流正“重新崛起”,新品牌如Raive(复古基调)和Rest&Recreation(中性风格)崛起,显示简约平价风单品(均价千元内)仍受捧。

3. 用户行为洞察:消费者因明星影响积极响应社交传播,导致品牌生命周期短,代理商转向新品牌引流,会员积分迁移策略延续用户忠诚。

4. 产品研发与定位:法式简约风格获短期成功,但需注重持久力;新品牌扩张类似快闪试水后开门店,建议创新设计以避免模式局限。

代理商曼多亚集中资源于新品牌,体现出市场适应性变革需求。

Mardi Mercredi闭店带来的市场政策解读和机会提示。

1. 政策解读:代理商曼多亚经营调整官方称部分门店优化,假货风险下需强化知识产权保护,避免仿冒品影响增长市场。

2. 消费需求机会:新品牌Raive和Rest&Recreation正快速扩张新开近10家门店,显示复古和中性风需求上涨,机会在切入新兴韩流趋势。

3. 风险与应对:潮牌短期走红后易落,事件负面影响如假货或加速闭店,正面在引流策略高效,小程序和会员迁移可借鉴以维护客户。

4. 商业模式提示:可学习Mardi从线上电商入华扩展线下路径,但需谨慎扩张;合作机会如与代理商新品牌联动,扶持政策如资源集中。

启示在应对市场波动优化供应链,及时转向高需求领域以规避风险。

Mardi Mercredi事件提供的产品设计和商业机会启示。

1. 产品生产和设计:Mardi单品均价千元内、法式简约风获成功,但假货问题暴露防伪需求;新品牌Raive复古基调和Rest&Recreation中性风格展现设计创新机会。

2. 商业机会:代理商转向新品牌并迅速扩张线下门店,工厂可合作开发类似平价潮品,如利用原址转换降低生产风险。

3. 推进数字化启示:品牌线上起家加速电商布局,假货泛滥提示加强电商渠道品质管控;代理商小程序风格统一高效引流,建议工厂融合数字营销优化生产周期。

该事件鼓励工厂探索新兴品牌如emis、Mmlg类似模式,延展生命周期以抓市场窗口。

从行业趋势和客户痛点看Mardi事件解决方案。

1. 行业发展趋势:潮牌如Mardi生命周期短暂、潮起潮落频繁,代理商转向新品牌显示韩流再兴趋势,扩张路径通过明星社交传播和快闪店试水标准化。

2. 新技术和痛点:假货泛滥成核心痛点,影响品牌形象;代理商声明为唯一合法运营商揭示保护需求,解决方案可加强版权监测技术。

3. 客户痛点应对:事件中会员体系迁移策略高效整合资源服务,新品牌沿用旧址和引流方式提供可持续解决方案,优化数字渠道管理。

4. 行业启示:针对类似新兴品牌如Rockfish Weatherwear,服务商可开发全渠道风控工具,支持品牌持久力建设。

总结在数字化服务应聚焦解决假货问题,提升行业适应力。

平台对Mardi事件的需求和管理做法分析。

1. 商业需求和问题:品牌闭店凸显平台需应对线下收缩风险,天猫旗舰店仍运营但新品上架未知,需强化渠道稳定招商吸引新品牌如Raive。

2. 平台最新做法:代理商在线转向新品牌,小程序和积分迁移展示平台引流创新;风向规避如假货问题需平台加强商家审核和知识产权保护。

3. 招商和运营管理:Raive和Rest&Recreation已入驻西单大悦城原址,平台可学习快速招商策略支持新品牌扩张,优化运营如会员体系整合。

4. 风险管理启示:针对潮牌高热度低持久模式,平台应建立风控机制监控假货风险,维护用户权益以吸引高质商家。

平台商可借鉴事件,将资源投入新兴需求领域确保商业生态韧性。

Mardi事件揭示的产业动向和政策商业模式启示。

1. 产业新动向:韩流重新崛起但潮牌生命周期短显现新问题,假货泛滥成行业挑战;新动向如Raive和Rest&Recreation扩张,显示模式创新需求。

2. 政策法规启示:代理商声明为唯一合法运营商提供版权保护建议,呼吁政策加强反仿冒执法;事件展示经营调整的政策合规实践。

3. 商业模式分析:Mardi线上起家扩张线下快速收缩,新兴品牌类似路径暴露局限性;建议研究如何延长生命周期,如优化数字化电商融合。

4. 产业启示:比较emis、Mmlg类似案例,研究者可探索可持续模式,聚焦用户行为与社交营销平衡点。

该事件强调产业动态监测重要性,为政策制定提供实操参考。

返回默认