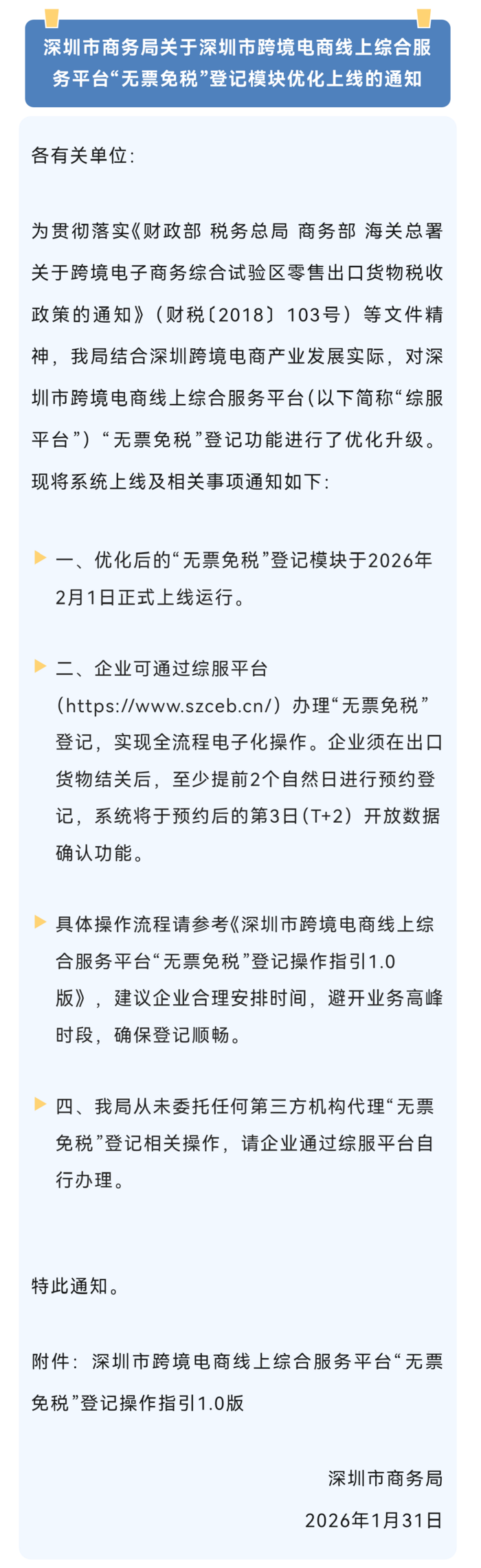

深圳跨境电商无票免税登记系统正式上线,解决出口企业无发票痛点,提供实操指南。

1. 企业通过深圳市跨境电商线上综合服务平台(https://www.szceb.cn/)全流程电子化办理登记,操作简便高效。

2. 登记要求出口货物结关后至少提前2个自然日预约,系统在预约后第3日开放数据确认功能,确保流程顺畅。

3. 系统适用于跨境电商零售出口企业,如9610出口清单的深圳企业,支持批量勾选和一键登记,提升审批效率。

4. 核心好处:真实出口企业即使无上游进项发票,也能免征增值税和消费税,避免灰色操作,转向合规申报。

新无票免税政策影响品牌出海策略,降低税务成本并引导合规趋势。

1. 免税机制减少增值税和消费税负担,可能优化产品定价策略,增强价格竞争力。

2. 政策推动合规申报,鼓励品牌建设正规出口渠道,避免“买单出口”等风险,提升品牌信誉。

3. 电子化系统提升效率,反映消费趋势向数字化电商转型,品牌可借此机会优化产品研发和用户行为观察。

4. 作为深圳企业专属福利,品牌需关注平台操作,以抓住出口增长机遇。

政策解读显示无票免税系统带来重大机会,提示风险并指导操作。

1. 政策核心:解决中小卖家采购无发票痛点,真实出口可免征增值税消费税,无需进项发票,提供合规路径。

2. 机会提示:引导卖家从灰色操作转向阳关化申报,降低税务成本,提升增长市场潜力;系统支持批量勾选和一键登记,提高效率。

3. 风险提示:需严格遵守预约要求(结关后提前2天预约,T+2确认),否则可能延误;适用对象限深圳企业特定申报方式,非深圳企业需注意。

4. 可学习点:通过综服平台全流程电子化操作,卖家应尽快适应新商业模式,抓住扶持政策机遇。

无票免税系统开辟出口商业机会,启示推进数字化生产。

1. 商业机会:作为产品供应商,工厂可受益于出口免税机制,吸引更多跨境电商订单,降低生产成本。

2. 产品生产启示:系统要求真实出口,工厂需确保产品设计符合出口标准,以利用免税优势提升竞争力。

3. 数字化启示:全流程电子化登记展示电商整合趋势,工厂可借鉴此模式推进自身数字化,优化供应链管理。

4. 适用深圳企业专属,工厂应关注平台操作,以拓展出口市场。

行业痛点解决和新技术应用推动服务需求。

1. 客户痛点:跨境电商企业长期面临无进项发票问题,导致税务合规困难,新系统提供直接解决方案。

2. 解决方案:优化升级的登记功能实现全流程电子化,支持批量操作,提升审批效率,服务商可借鉴此模式开发类似工具。

3. 新技术:电子化平台和T+2确认机制展示数字化趋势,服务商应关注行业向合规化转型的机遇。

4. 行业发展趋势:政策引导真实交易,服务商需提供配套服务,如培训或系统集成,以应对市场变化。

平台新功能和运营管理优化,满足企业需求并规避风险。

1. 商业需求:企业对平台依赖性强,需通过深圳市综服平台或单一窗口申报,平台应确保系统稳定以吸引招商。

2. 最新做法:平台优化登记功能,实现全流程电子化,支持批量勾选和一键确认,提升运营效率。

3. 运营管理:设置预约规则(结关后提前2天预约,T+2开放),平台需加强风控,规避延误风险。

4. 风向规避:适用对象限深圳企业,平台应明确规则,避免非合规企业使用,确保合规申报。

产业新动向揭示政策启示和商业模式创新。

1. 产业新动向:深圳上线无票免税登记系统,标志跨境电商出口合规化重大进步,解决灰色操作问题。

2. 新问题:政策引导企业转向阳关申报,但适用对象局限深圳企业,需扩展研究全国推广可能性。

3. 政策法规启示:免税机制基于真实出口,免征增值税消费税,为法规制定提供参考,建议优化税收框架。

4. 商业模式:电子化批量操作提升效率,研究者可分析此模式对产业数字化转型的推动效应。

返回默认