总1:物流体系新规

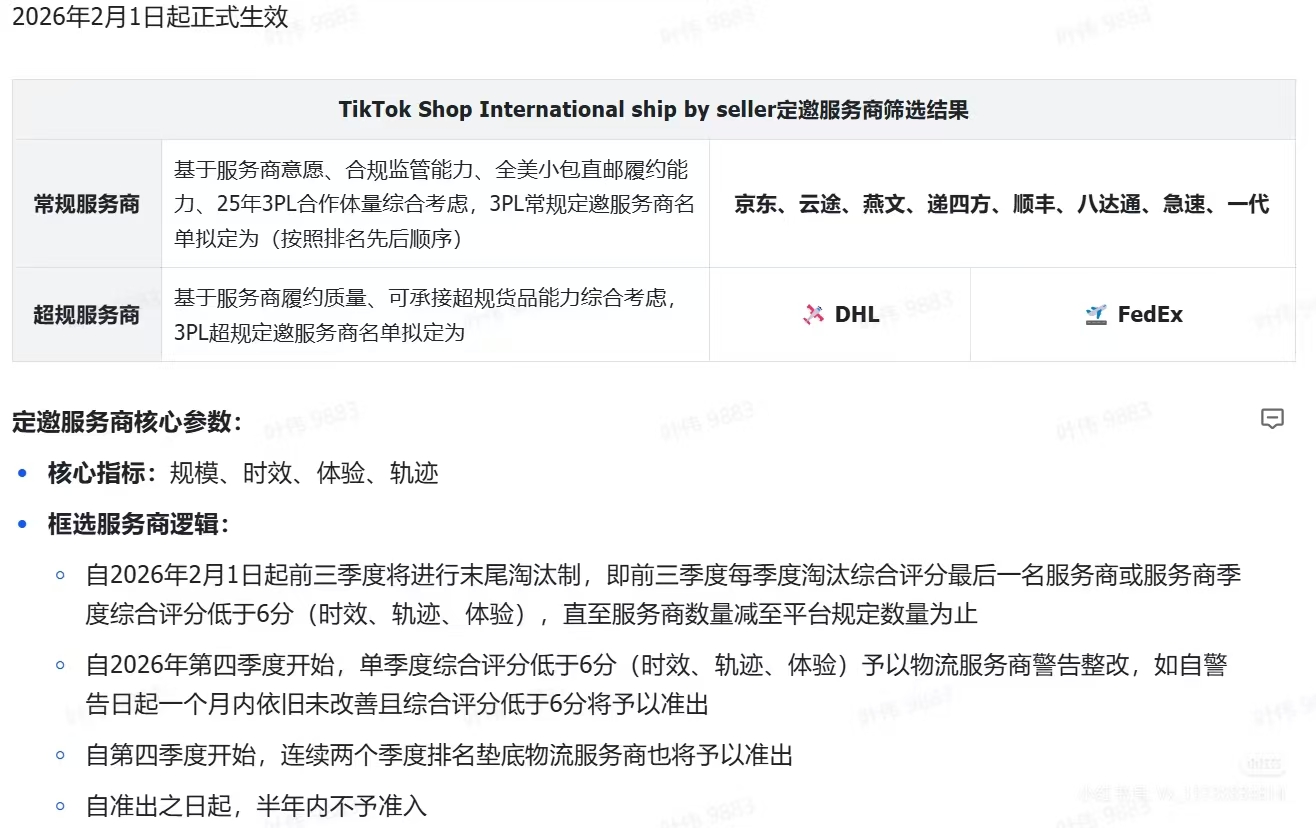

1.平台引入“定邀白名单”制度,指定8家常规物流商(京东、云途、燕文、递四方、顺丰、八达通、急速、一代)和2家超规物流商(DHL、FedEx),仅允许使用这些服务商,覆盖中小件和普通时效或大件、高时效需求。

2.物流商面临绩效监管和动态淘汰机制,包括规模、时效、履约体验和轨迹完整性四大指标考核,季度末位淘汰或评分低于6分即清退。

总2:商家准入收紧

1.直邮权限由开放模式改为“行业特批白名单”,仅对特殊类目、稀缺商品或平台扶持商家定向邀约开通,中小卖家无法自主申请。

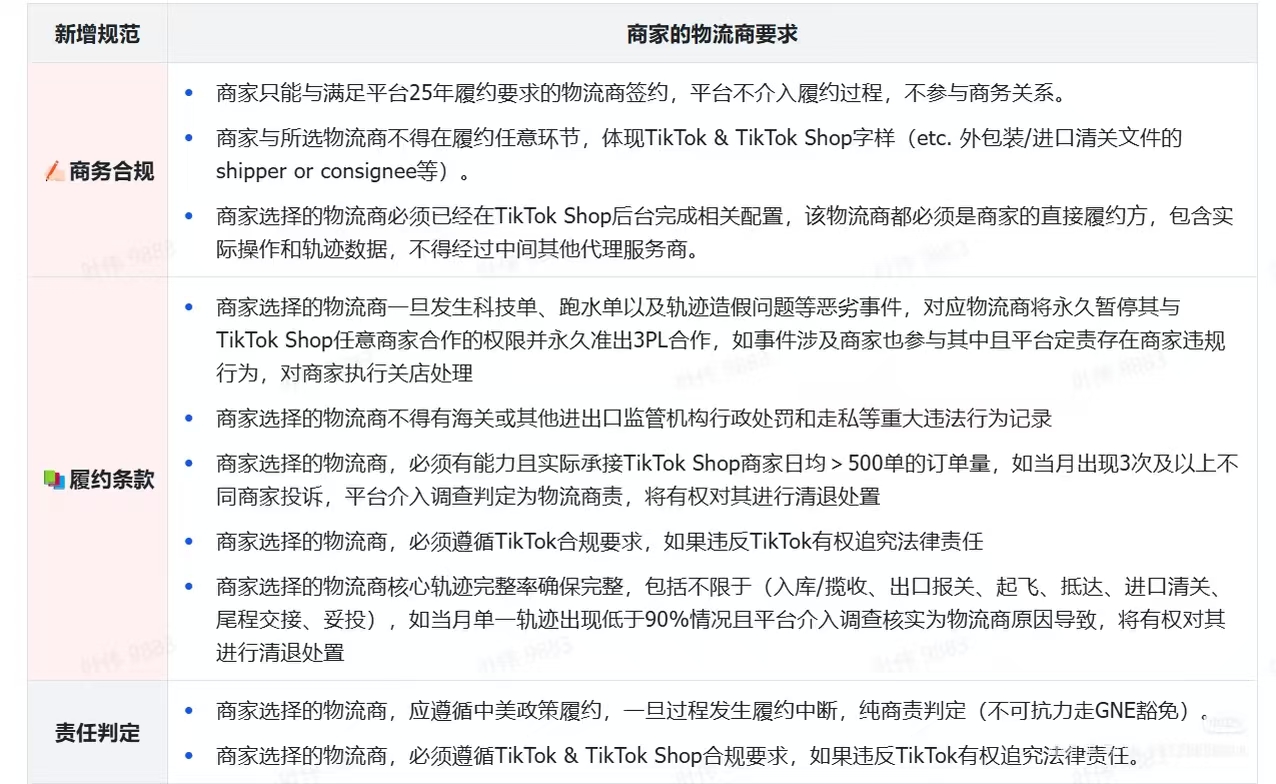

2.商家与物流商合作时,禁止外包装或清关文件体现“TikTok”相关字样,必须直接使用官方配置物流商,禁止中间代理。

总3:持续考核要求

1.商家需强制提升FBT全店渗透率,并在规定周期内达标,否则关闭直邮权限;还须在3个月内跃迁至T3等级(月销6.5万美元以上),否则清退资格。

2.消费者负反馈机制首次超标警告,第二次清退;履约指标细化如准时交货率低于80%或轨迹完整度低于90%,将触发限单、罚款等处罚。

总4:处罚措施与目标

1.虚假轨迹罚款5美元每单,月度轨迹完整度需不低于90%,否则等同处罚;延迟履约率不低于4%等指标超标将扣分、延长账期。

2.新规标志平台转向合规、稳定和精细化运营阶段,门槛显著提高。

总1:物流对品牌产品的影响

1.高价值或易碎商品需通过超规物流商DHL或FedEx交付,支持3-5天达的时效需求,影响品牌产品研发和定价策略。

2.物流环节禁止在外包装或清关文件中使用“TikTok”相关字样,避免合规风险,确保品牌渠道建设安全。

总2:消费趋势与用户行为

1.消费者对高时效商品的需求凸显,如3-5天达服务,反映用户行为偏好,品牌可借此优化产品设计。

2.平台强调履约质量,物流商需确保轨迹完整和体验,品牌在营销中可融入可靠性元素,提升用户信任。

总3:机会与启示

1.稀缺商品或特殊类目商家有机会获得定向邀约,品牌商可关注此方向拓展市场;趋势转向精细化运营,品牌需强化产品兼容性和合规管理。

2.相关数据如准时交货率80%要求,代表企业DHL、FedEx案例,提供实操参考,助力品牌应对渠道变化。

总1:政策解读与市场变化

1.直邮权限实行“行业特批白名单”,仅定向邀约开通,中小卖家失去申请入口,门槛提高;需完成商家等级跃迁至T3(月销6.5万美元以上),否则清退资格。

2.FBT全店渗透率强制要求,商家需提升官方仓配模式比例,未达标关闭权限;新规转向合规精细化运营,增长市场更依赖头部资源。

总2:风险提示与应对措施

1.风险包括未达履约指标(如准时交货率低于80%或轨迹完整度低于90%)触发限单、罚款、关店;消费者负反馈首次超标警告,第二次清退。

2.物流商涉及轨迹造假或跑水单等行为,商家参与将关店处理;需直接使用指定物流商,避免代理风险,确保合作合规。

总3:机会提示与可学习点

1.机会仅针对定向邀约商家,如特殊类目或稀缺商品;扶持政策如平台绩效监管,可学习提升物流合作和履约效率。

2.最新商业模式强调稳定,卖家可关注数据指标如轨迹完整度90%要求,优化运营;应对措施包括选择常规物流商(如云途)应对中小件需求。

总1:产品生产与物流需求

1.大件商品或特殊品类需通过超规物流商DHL、FedEx交付,工厂产品设计应考虑适配此类物流方案,确保高效履约。

2.物流轨迹完整要求(入库至妥投全流程),影响工厂交付流程;如轨迹完整度低于90%或导致清退,需强化生产与物流对接。

总2:商业机会与电商启示

1.机会在于与指定物流商(如京东、顺丰)合作,承接平台日均500单以上能力需求,工厂可成为供应链伙伴;商业趋势转向合规,提供启示推动数字化管理。

2.代表企业案例如DHL用于高时效商品,工厂可借鉴开发高价值产品;推进电商启示包括关注履约指标(如准时率80%),优化生产计划。

总3:风险与适配

1.风险如物流商违规(轨迹造假)影响合作,工厂需确保产品符合标准;新规门槛提高,启示工厂聚焦头部资源和高绩效模式。

总1:行业发展趋势与客户痛点

1.趋势转向精细化运营,物流服务商需接受动态淘汰机制(季度末位淘汰或评分低于6分清退),反映行业合规化强化。

2.客户痛点包括轨迹完整性要求(全流程不低于90%),若缺漏引发调查清退;规模能力需日均500单以上,未达标者面临一票否决。

总2:新技术与解决方案

1.平台引入绩效监管系统,基于规模、时效等指标,服务商可优化技术提升轨迹追踪和数据完整性。

2.解决方案限于使用指定物流商名单,服务商需整合资源避免违规;问题如有效投诉三次以上导致清退,可通过提升履约体验解决。

总3:机会与风险

1.机会在平台仅允许8家常规和2家超规服务商,竞争集中;风险如海关违法记录等红线直接清退,半年禁入;服务商可学习优化运营模式。

总1:平台最新做法与招商

1.实施“定邀白名单”制度,物流侧指定第三方服务商(常规8家、超规2家),招商仅限这些企业参与;商家侧准入收紧为定向邀约,聚焦特殊类目或稀缺商品。

2.运营管理包括绩效监管(季度淘汰、评分低于6分警告)、动态调整物流商数量,最终缩减至平台设定范围。

总2:需求问题与风险规避

1.商业对平台问题包括轨迹完整度需求(不低于90%),平台设置清退机制如月度超标调查处理;风险规避通过一票否决红线(如违法记录或投诉三次)。

2.平台需求商家合作直接使用物流商,禁止代理;管理措施如FBT渗透率强制要求,优化仓配模式;风向规避包括处罚虚假轨迹每单5美元罚款。

总3:管理启示与目标

1.新规标志平台转向合规稳定阶段,启示强化精细化运营;招商依赖头部物流资源,提升整体履约质量。

总1:产业新动向与新问题

1.动向为TikTok美区直邮实施“白名单制度”,物流和商家准入收紧,标志业务从高速扩张转向合规精细化运营阶段。

2.新问题包括物流商动态淘汰风险(季度末位清退)、商家准入门槛提高导致中小卖家淘汰,以及轨迹造假等违规行为增加行业不确定性。

总2:政策法规建议与启示

1.政策启示如平台设置多重红线(违法记录、订单能力要求),研究者可分析法规完善空间;履约指标细化(如准时率80%)提供执法参考。

2.商业模式转向头部资源集中,启示市场结构变化;数据如月销6.5万美元T3等级要求,代表案例DHL、FedEx,助力研究产业演变。

返回默认