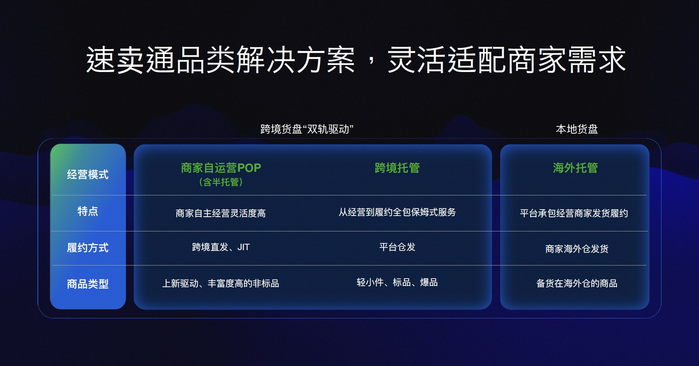

速卖通调整跨境品类解决方案,明确“POP+跨境托管”双轨驱动策略,提升POP商家地位,提供实操干货。

1. POP发货时效要求放宽,新品上网时效从72小时延长至96小时,增加商家灵活性。

2. 优质POP商家获得全方位支持,包括新品孵化、重点国家流量、免罚额度、供应链优惠、发品额度和结算周期优化。

3. 非标品类鼓励POP模式自主经营,可选择半托管或JIT发货;标品建议仓发主打低价,平台提供“N元N件”和“超级爆发日”营销渠道。

4. 平台不强制造商仓发,商家可自行选择模式,仓发品主推性价比,POP商品主推丰富度。

5. 速卖通送货时效缩短50%,重点国家送达时效提升到5-7天,Choice订单占比达70%,显示平台效率提升。

速卖通策略调整影响品牌运营,涉及渠道建设、定价竞争和产品研发。

1. 品牌渠道建设:POP模式提升地位,允许品牌自主经营非标品类,选择灵活发货方式如半托管或JIT,增强品牌控制力。

2. 品牌定价和价格竞争:标品仓发主打低价策略,可能影响品牌定价;非标品POP模式主推丰富度,避免价格战。

3. 产品研发和消费趋势:非标品类鼓励产品多样性,涉及研发创新;用户行为偏好快速交付,送货时效缩短50%,重点国家5-7天送达,反映消费趋势。

4. 平台支持机会:优质POP商家获得流量和孵化支持,提供品牌营销机遇,Choice订单占比70%显示平台增长潜力。

政策解读揭示增长机会和扶持措施,帮助卖家应对变化。

1. 政策解读:速卖通明确“POP+托管”双轨驱动,POP地位提升,放宽发货时效、升级金银牌体系,Choice商品分层管理。

2. 机会提示:非标品类POP模式提供灵活经营机会,标品仓发有营销渠道如“N元N件”;优质POP商家获得新品孵化、流量和免罚额度支持。

3. 风险提示和应对:不强制造商仓发,商家可自行选择模式,避免强制风险;仓发品主打低价,POP商品主推丰富度,分散经营风险。

4. 扶持政策和合作方式:平台提供全方位支持,包括供应链优惠和结算周期优化;半托管作为物流升级服务,增加全托管通道,便于合作。

策略提供产品生产和电商启示,揭示商业机会。

1. 产品生产和设计需求:标品和轻小件商品建议仓发生产,主打低价;非标品类适合POP模式,鼓励产品丰富度和设计创新。

2. 商业机会:POP模式提升地位,提供灵活性如JIT发货,工厂可参与非标品供应;仓发权益加码,涉及标品生产机会。

3. 推进数字化和电商启示:物流时效缩短50%,重点国家5-7天送达,显示电商效率提升;Choice订单占比70%,启示数字化供应链管理。

行业趋势和客户痛点解决方案,提供发展导向。

1. 行业发展趋势:速卖通提升POP地位,实施双轨驱动策略,Choice业务占比70%成为增长主力。

2. 客户痛点:物流时效问题突出,商家需应对发货要求;商品定位模糊,需清晰区分POP和托管。

3. 解决方案:平台放宽POP发货时效至96小时,提供半托管或JIT选项;商品分层管理,非标品鼓励POP,标品建议仓发,解决定位问题;时效提升50%显示物流优化方案。

平台最新做法满足商业需求,涉及招商和运营管理。

1. 平台的最新做法:明确“POP+跨境托管”双轨驱动,POP地位提升,放宽发货要求、升级金银牌体系,Choice商品分层。

2. 商业需求和问题:商家需清晰运营方向,平台提供非标品POP自主经营、标品仓发低价策略;不强制造商仓发,解决强制风险。

3. 平台招商和运营管理:加大对优质POP商家的投入,提供流量、免罚额度和孵化支持;仓发权益加码,涉及“N元N件”营销渠道;运营中送货时效缩短50%,重点国家5-7天送达,优化管理。

产业新动向和商业模式分析,提供政策启示。

1. 产业新动向:速卖通从Choice业务重点转向POP提升,实施双轨驱动策略,反映电商平台调整;送货时效缩短50%,重点国家5-7天送达,显示物流进步。

2. 商业模式:POP与托管各有定位,非标品POP主推丰富度,标品仓发主打低价;Choice订单占比70%,体现托管模式主导。

3. 政策法规建议和启示:平台不强制造商仓发,商家可自行选择,启示灵活监管;商品分层和金银牌体系升级,提供运营优化启示;数据如时效提升和订单占比,支持产业研究。

返回默认