钱大妈关键业务数据和实用策略

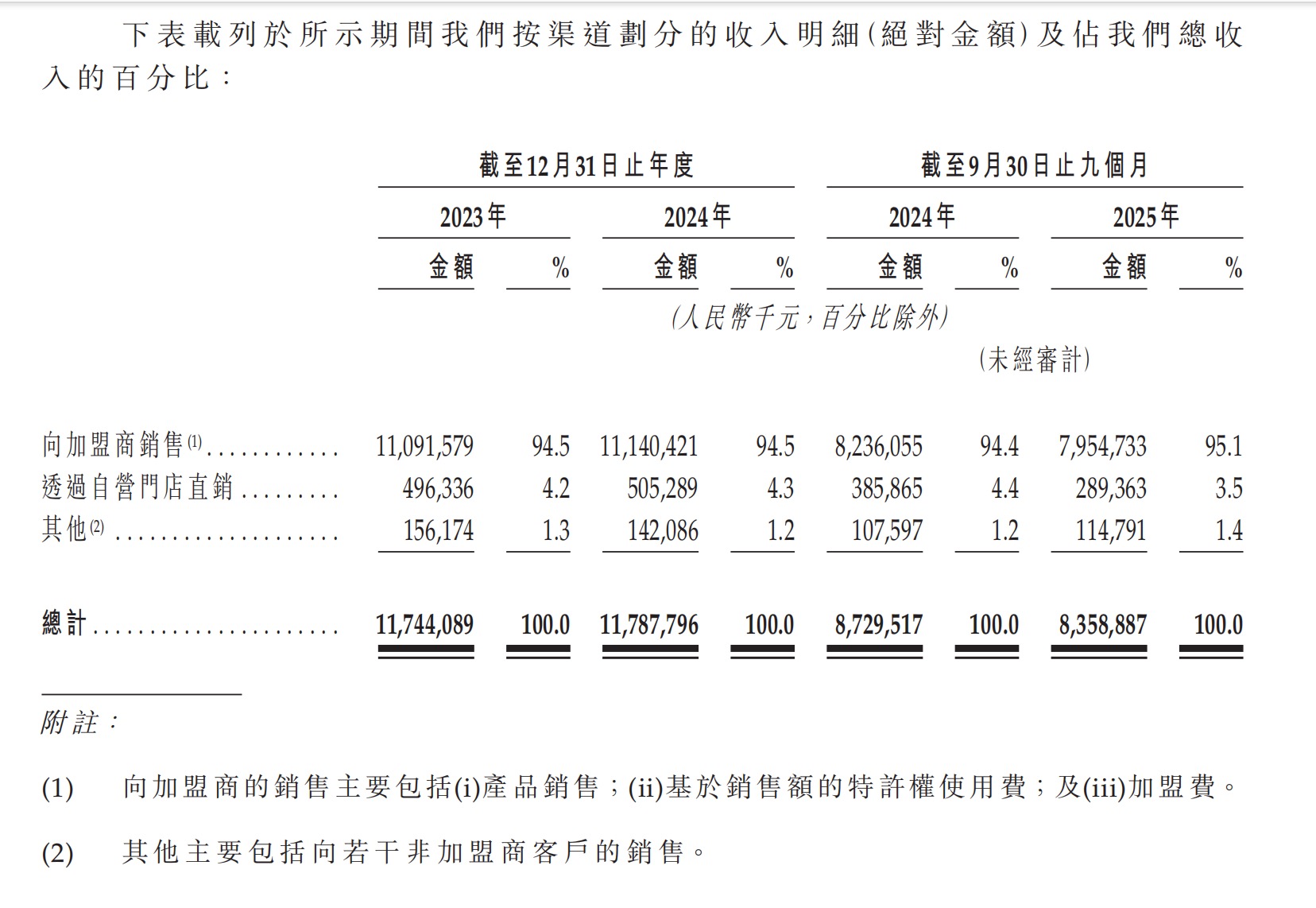

1.2024年收入117.88亿元,净利润2.88亿元;2025年前九个月收入83.59亿元,亏损2.88亿元,毛利率在10.2%至11.3%之间波动。

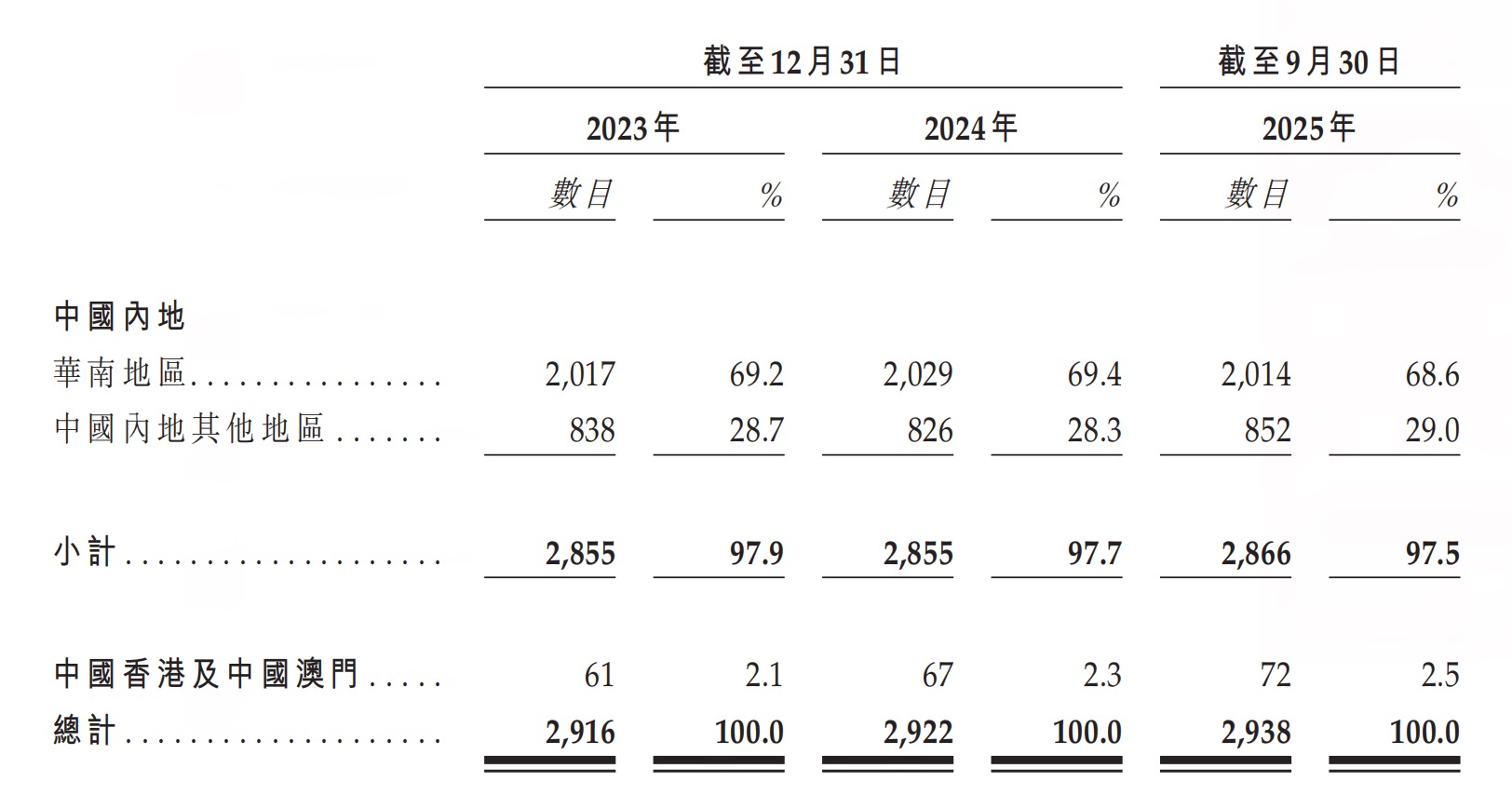

2.门店总数2938家(2898家加盟店,40家自营店),采用折扣日清模式,晚上7点后递增折扣出清产品,确保新鲜度。

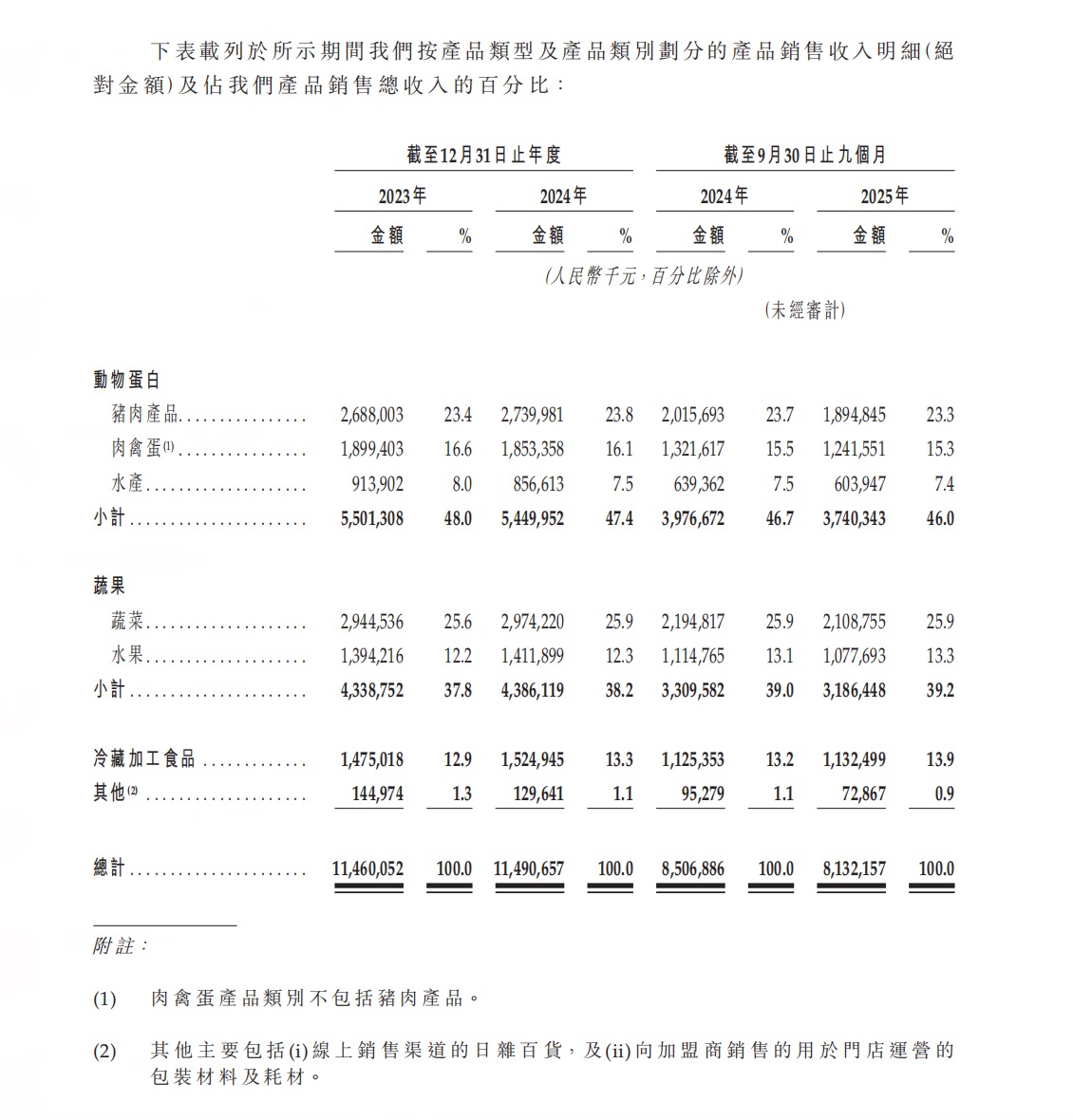

3.产品包括775个SPU,猪肉和蔬菜收入占比近50%,GMV达148亿元,连续五年行业第一。

未来发展规划和实操干货

1.加强门店网络覆盖,挖掘下沉市场增长机会,提升华南地区渗透率。

2.拓展线上渠道,利用即时零售服务满足需求,通过次日达服务拓宽品类。

品牌营销和渠道建设

1.品牌以“不卖隔夜肉”标准为核心定位,应用于所有生鲜产品,强化消费者信任和高质价比形象。

2.募集资金用于品牌营销工作,包括扩展门店网络和丰富产品组合,提升市场影响力。

3.品牌定价策略采用折扣日清模式,晚上7点后递增折扣,促进销售并减少库存风险。

产品研发和消费趋势

1.产品组合包括动物蛋白、蔬果等6大类,775个SPU,猪肉和蔬菜占主导,显示研发重点。

2.消费趋势显示社区生鲜需求增长,GMV达148亿元行业领先,用户偏好新鲜高效服务。

合作机会和风险提示

1.加盟模式是主要收入来源(95%),提供产品销售、特许权使用费和加盟费机会,可学习其门店网络管理。

2.最新商业模式包括折扣日清和即时零售服务,拓展线上需求,合作方式灵活。

增长市场和事件应对

1.下沉市场是未来增长点,计划通过“加密一城,辐射周边”策略挖掘机会。

2.风险包括盈利波动,2025年前九个月亏损2.88亿元,需关注财务稳定性。

3.机会提示:华南地区销售毛利率达12.5%,高于其他区域,可借鉴区域密度策略。

产品生产和设计需求

1.高需求产品如猪肉和蔬菜,占收入近50%,显示生产重点应聚焦生鲜品类。

2.产品设计需满足新鲜度标准,如“不卖隔夜肉”,确保快速周转。

商业机会和数字化启示

1.供应链合作机会:16个综合仓高效运作,周转时间不超过12小时,提供配送支持。

2.推进数字化启示:未来加强数字化基础设施,启示工厂可优化电商和智能生产流程。

行业发展趋势和客户痛点

1.生鲜零售趋势向高效配送发展,钱大妈周转时间仅12小时,高于行业平均2至4天。

2.客户痛点包括新鲜度保持和库存管理,解决方案是综合仓系统实现当天出清。

新技术和解决方案

1.即时零售服务是未来重点,满足线上需求,提供次日达品类拓宽方案。

2.数字化和智能化基础设施加强计划,启示服务商开发相关技术支持。

平台招商和运营管理

1.加盟模式提供招商机会,门店网络扩展中,平台可吸引加盟商合作。

2.运营管理采用“加密一城,辐射周边”策略,区域密度提升效率,华南毛利率达12.5%。

风险规避和平台需求

1.盈利风险如2025年亏损,需规避财务波动,通过策略调整应对市场变化。

2.商业对平台需求包括供应链支持,16个综合仓高效运作,平台可优化配送管理。

商业模式和产业新动向

1.折扣日清模式创新,结合加盟体系,GMV达148亿元连续五年行业第一。

2.供应链效率新动向:周转时间不超过12小时,高于行业平均,提升产业标准。

政策启示和未来问题

1.下沉市场挖掘和即时零售拓展是未来动向,启示政策支持社区生鲜发展。

2.新问题如盈利波动,2025年亏损,需研究商业模式可持续性。

返回默认