化妆工具行业重点企业倒闭事件频发,实操干货揭示市场风险。

总:企业关停动态展示行业下滑。

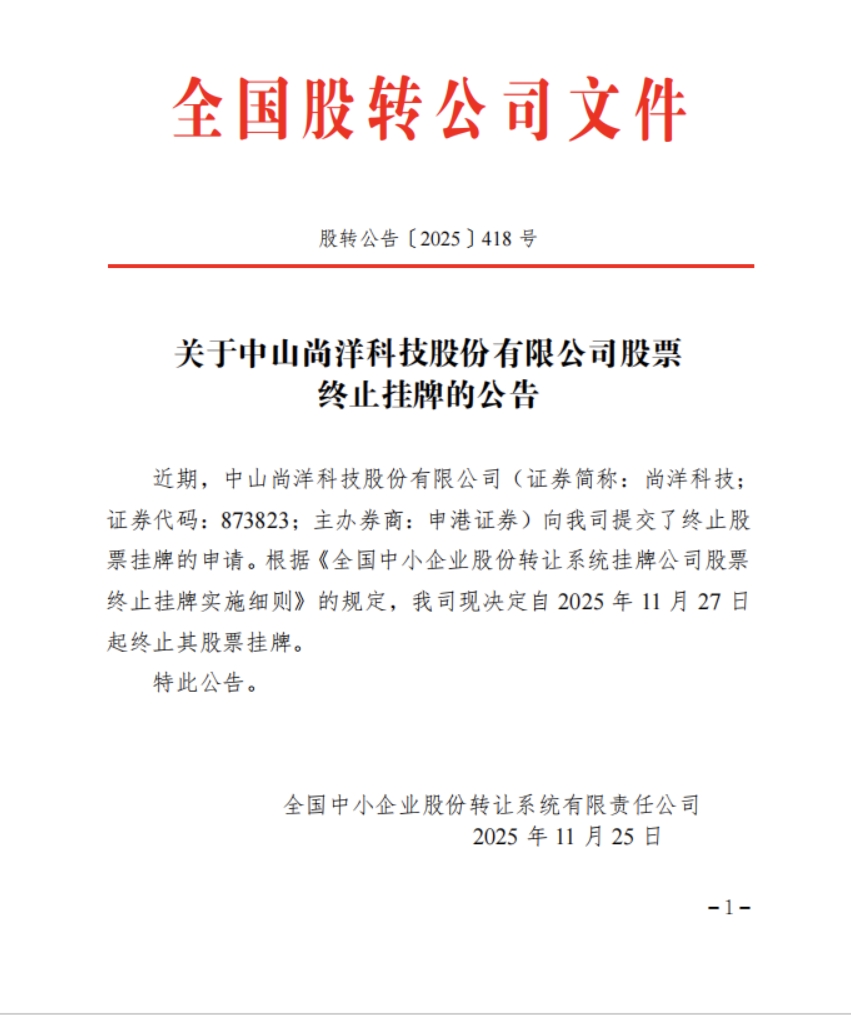

1. 尚洋科技终止新三板挂牌,上半年营收下降19.28%。

2. 其他品牌如lisaslab和POOCODI相继闭店,淘宝店铺消失。

总:企业高度依赖外部因素。

1. 大客户依赖85.22%,出口占比94.76%。

2. 财务指标下滑:净利润降28.44%,毛利率降2.23点。

品牌营销和渠道依赖风险成为焦点,学习点助力品牌策略优化。

总:代工业务暴露品牌合作隐患。

1. 尚洋科技为欧莱雅等代工,大客户收入占比85.22%。

2. 出口渠道压力导致收入下滑19.96%,内销下降4.69%。

总:消费趋势下滑需品牌转型。

1. 多个品牌关闭(如lisaslab),显示工具类需求萎缩。

2. 用户行为观察:依赖高端品牌易受市场波动。

事件应对和风险提示突出,机会提示与可学习点引导经营决策。

总:市场下滑事件的风险应对关键。

1. 尚洋科技终止挂牌和闭店案例显示高度依赖客户风险。

2. 负面影响:营收下降20.96%,利润降24.02%,警示流动性问题。

总:增长市场机会在多元化。

1. 消费需求变化:境内收入较小但下滑较缓(降4.69%),可开发国内新市场。

2. 可学习点:从ODM模式学习避免单一依赖,寻找合作方式如电商平台整合。

产品生产和设计需求启示商业机会,电商推进面临挑战与出路。

总:代工生产的依赖引发商业危机。

1. ODM企业依赖大客户(85.22%)和出口(94.76%),产品需求下滑20.96%。

2. 设计需求:出口压力下,需优化产品结构应对波动。

总:推进数字化和电商的启示有限但有警醒。

1. 商业机会:境内市场降幅小(0.06亿营收),可转向本土客户。

2. 电商启示:lisaslab淘宝店铺关闭案例,显示平台风险需加强电商策略。

行业发展趋势和客户痛点凸显解决方案需求。

总:化妆工具行业下行趋势明显。

1. 尚洋科技财务下滑(收入降19.28%),多个品牌闭店案例。

2. 痛点:大客户依赖85.22%和出口94.76%导致收入不稳定。

总:解决方案需针对风险规避。

1. 行业问题:依赖单一渠道易受国际影响(出口降19.96%)。

2. 建议方案:帮助企业多元化客户群,提升内销应对。

平台运营管理需规避风向风险,招商新做法响应商户需求。

总:商业对平台的需求暴露问题与最新做法。

1. lisaslab等淘宝店铺关闭,显示平台流失和招商挑战。

2. 风险规避:商户依赖大客户引发放缓,需强化运营维护。

总:平台招商最新启发。

1. 商户需求:高度依赖外部因素(出口94.76%),需平台提供多元支持。

2. 运营管理:从闭店案例学习风险防控,增强稳定伙伴关系。

产业新动向和商业模式问题揭示政策启示。

总:ODM商业模式脆弱性问题显现。

1. 新动向:尚洋科技退出市场,依赖出口模式导致收入下滑近20%。

2. 新问题:大客户集中(85.22%)放大波动,利润降28.44%。

总:政策法规建议基于数据启示。

1. 商业模式弊端:高度代工易受外部冲击,需转向多元发展。

2. 启示:从闭店案例(如POOCODI)建议支持国内市场和分散风险策略。

返回默认