文章揭示了春节送礼给长辈的消费趋势和实用建议,帮助读者把握年货选购重点。

1. 春节是“送长辈”关键词搜索量最高的节日,占比78%,显示家庭情感浓度高,45.6%消费者第一波年货购置优先考虑父母长辈。

2. 选礼关注点:健康安全(47.1%)、真实需求与喜好(46.8%)、实用性与使用频率(42.4%),体现孝心表达从外在标签转向实际生活提升。

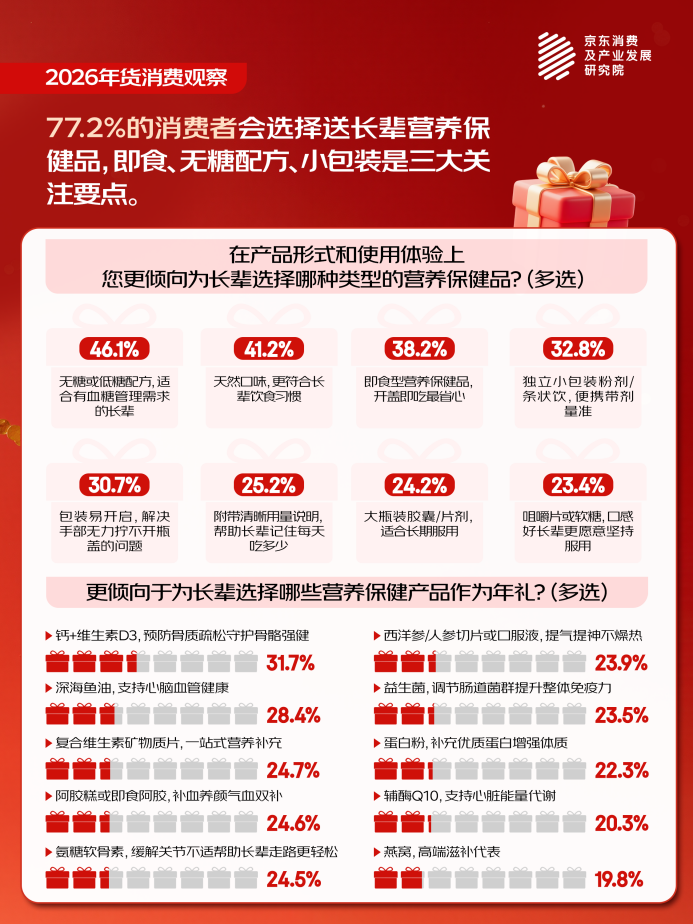

3. 营养保健品偏好:46.1%关注无糖或低糖配方,38.2%偏好即食型产品(如阿胶糕),32.8%青睐独立小包装,强调易用性和精准剂量。

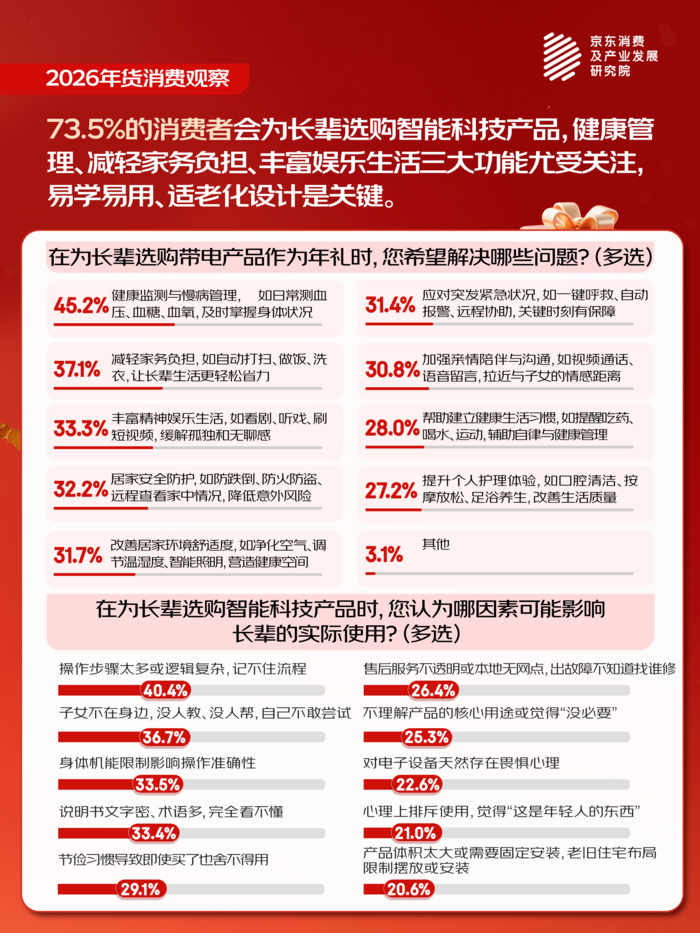

4. 智能设备选购:健康监测(45.2%)、减轻家务(37.1%)、精神娱乐(33.3%)为主要功能,但痛点包括操作复杂(40.4%)和无人教学(36.7%),建议选择易学产品。

5. 食品礼盒:54.2%首要关注配料干净,44.4%考虑长辈口味,33.3%追求尝鲜,促进亲情新话题。

文章提供了年货消费的用户行为洞察和产品研发启示,助力品牌优化营销策略。

1. 消费趋势:春节送礼转向“长辈真实需求”,77.2%选择营养保健品,83.6%选食品礼盒,健康回归成主流,如54.2%关注配料干净。

2. 用户行为:选礼逻辑从“我想送”到“长辈能用”,健康安全为首要考量,产品形态偏好精细化,如即食型保健品(38.2%)和小包装(32.8%),体现易用性需求。

3. 品牌营销:适老化设计成加分项,如包装易开启(30.7%)和清晰用量说明,可提升用户依从性;马年主题礼盒受65.6%消费者青睐,需结合传统文化与现代实用。

4. 产品研发:针对痛点开发,如智能设备操作简化,食品礼盒强调健康配料;农村市场增长机会大,如扫地机器人销量环比增121%。

文章分析了年货市场增长机会和风险,为卖家提供策略参考。

1. 增长市场:春节送礼需求强劲,“送长辈”搜索占比78%,食品礼盒搜索环比增超60%,纯坚果礼盒增10倍;农村市场家电销量亮眼,扫地机器人增121%,嵌入式微蒸烤一体机增114%。

2. 消费需求变化:转向实用高频使用,47.1%关注健康安全,46.8%重真实需求;机会点包括即食保健品(38.2%)、适老化智能设备(如电子血压计32.4%)。

3. 风险提示:智能设备痛点突出,40.4%担忧操作复杂,36.7%因无人教学可能退货;选礼需避免束之高阁,42.4%强调实用性。

4. 合作与模式:可学习京东平台做法,如年货节启动后搜索激增;扶持适老化产品合作,解决安装和教学痛点。

文章指出产品生产设计需求和电商机会,为工厂提供生产启示。

1. 生产设计需求:营养保健品需无糖低糖配方(46.1%)、即食型(38.2%)和独立小包装(32.8%),强调易开启包装和剂量精准;智能设备应简化操作,避免复杂步骤(痛点40.4%)。

2. 商业机会:健康产品需求高,如骨骼健康、心脑血管养护类保健品;农村市场家电增长快,扫地机器人销量增121%,洗碗机等增幅超70%,可开发适老化版本。

3. 数字化电商启示:年货节带动搜索环比增超60%,食品礼盒等品类热销;推进电商需关注用户痛点,如无人教学(36.7%),可整合线上指导服务。

文章揭示了行业趋势、客户痛点和解决方案方向,服务商可优化服务。

1. 行业趋势:年货消费健康化,54.2%食品礼盒关注配料干净,77.2%选保健品;智能设备需求增,73.5%消费者为长辈选购,功能聚焦健康监测(45.2%)和家务减轻(37.1%)。

2. 新技术与痛点:适老化设计不足是核心问题,40.4%用户反馈操作复杂,36.7%因无人教学阻碍使用;痛点包括屏幕字体小(33.5%)和安装困难。

3. 解决方案:针对痛点开发易用服务,如提供远程教学支持;整合健康数据管理,如电子血压计(32.4%)和血糖仪(29.6%)的监测方案;优化包装设计服务,确保易开启(30.7%)和清晰说明。

文章反映了平台需求和运营策略,帮助平台规避风险。

1. 商业对平台需求:用户需易用产品,如操作简化智能设备(痛点40.4%)和适老化设计;搜索需求高,“送长辈”占比78%,食品礼盒搜索环比增超60%,需优化推荐算法。

2. 平台最新做法:京东年货节启动后,礼盒搜索激增,纯坚果礼盒增10倍;平台数据显农村家电销量增幅大,如扫地机器人增121%,可加强招商。

3. 运营与风险规避:需管理用户痛点,如无人教学(36.7%)可能导致退货,增加在线指导功能;风向规避建议关注健康安全标准(47.1%),避免虚假宣传;招商重点在适老化产品和马年主题礼盒(65.6%兴趣)。

文章探讨了产业动向和新问题,为研究提供政策启示。

1. 产业动向:孝心消费进阶,从礼物标签转向实际生活融入,如47.1%关注健康安全,体现理性化;农村市场升级,家电销量增,如扫地机器人121%增长,反映消费结构变化。

2. 新问题:适老化设计缺失,智能设备操作复杂(40.4%痛点)和教学缺位(36.7%);商业模式需创新,如马年礼盒(65.6%兴趣)结合传统与现代实用。

3. 政策建议:加强产品适老化标准制定,如包装易开启(30.7%)和用量提示;法规需关注健康安全,如食品配料干净(54.2%),并提出政策支持农村电商发展。

返回默认