2025双11京东服饰销售数据亮眼,消费者购物首选京东平台。

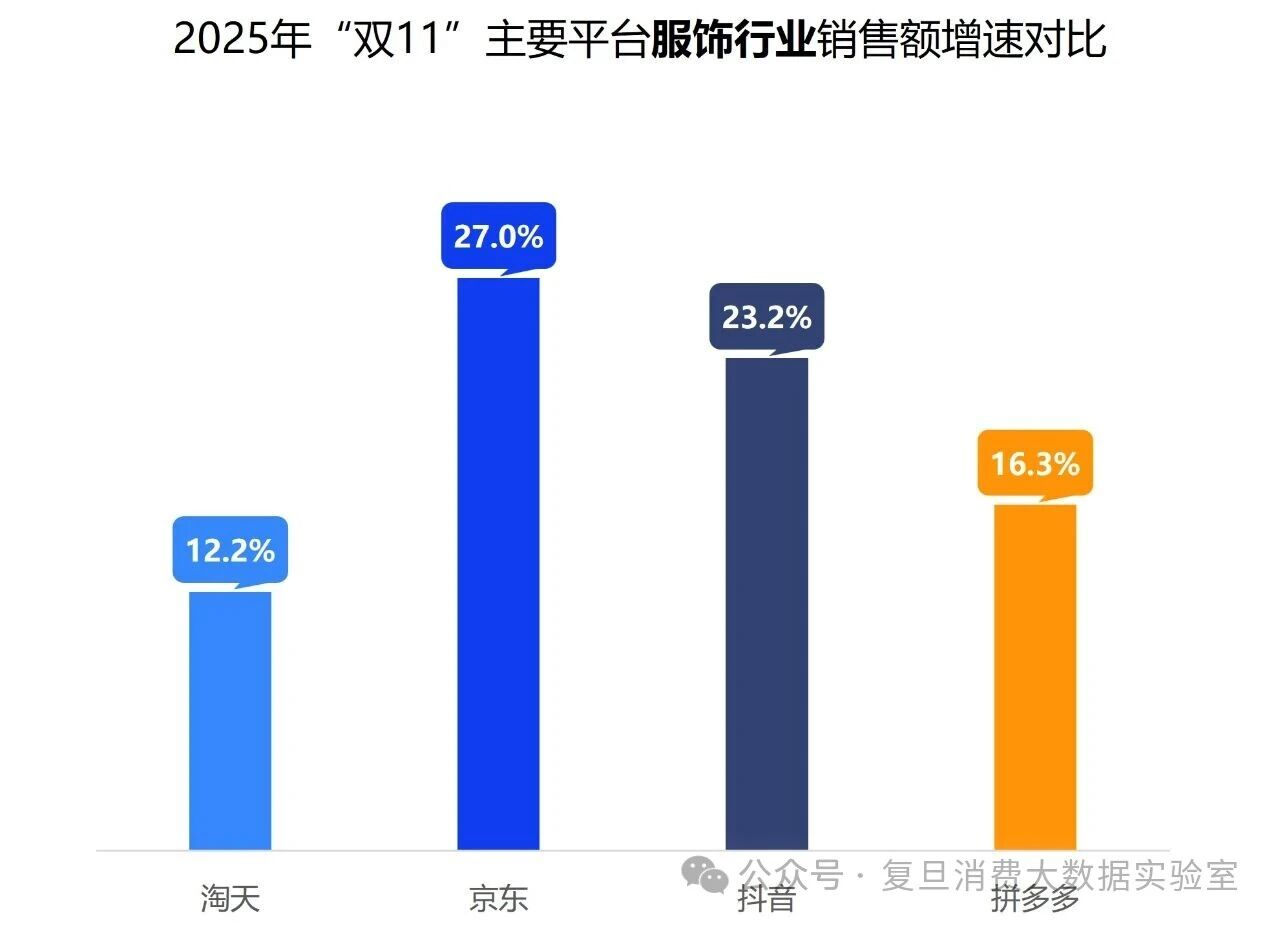

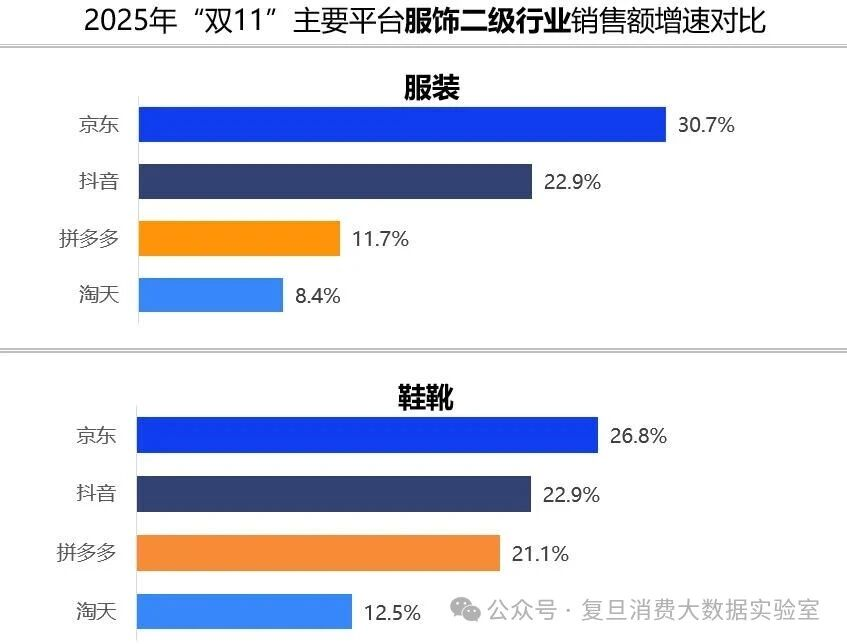

1. 京东服饰品类整体增速27%,领先淘天等平台,服装和鞋靴品类表现最佳。

2. 多个商品和品牌成交额翻倍:皮草、女士羽绒马甲、男士棉马甲等翻倍增长,近2000个品牌翻倍,超1000家服饰品牌翻倍,波司登新品增长113%,保暖品牌高梵等翻倍。

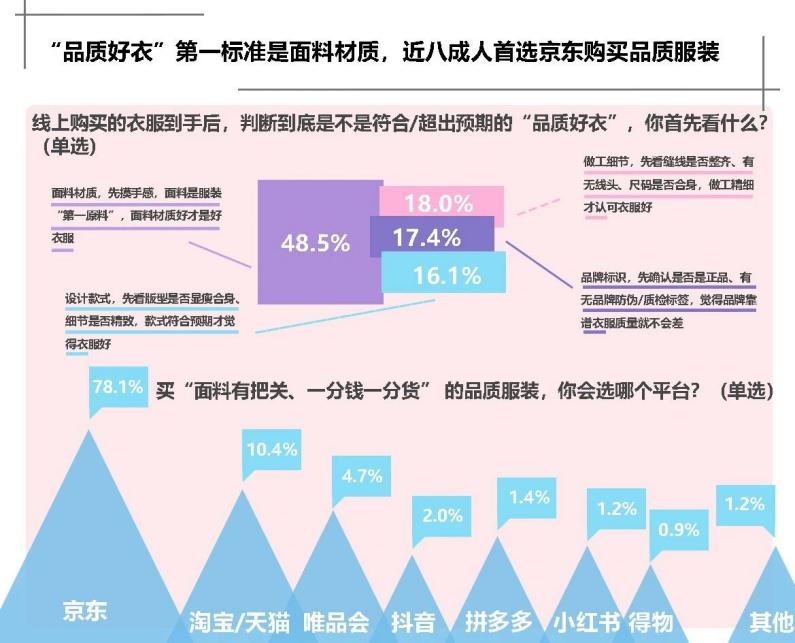

3. 实用购物建议:选购时关注面料材质、充绒量等硬指标,优先选择打标JD FASHION的产品,京东严选品质面料和价格合理的设计单品。

双11显示京东是品牌增长的关键渠道,消费趋势偏品质导向。

1. 品牌营销机会:京东平台上近500个细分品类翻倍增长,品牌如波司登新品销售增长113%,可借鉴新品推广策略。

2. 品牌渠道建设:80%消费者首选京东购买品质服饰,品牌可通过加入JD FASHION频道提升曝光,严选产品拉动成交额增长288%。

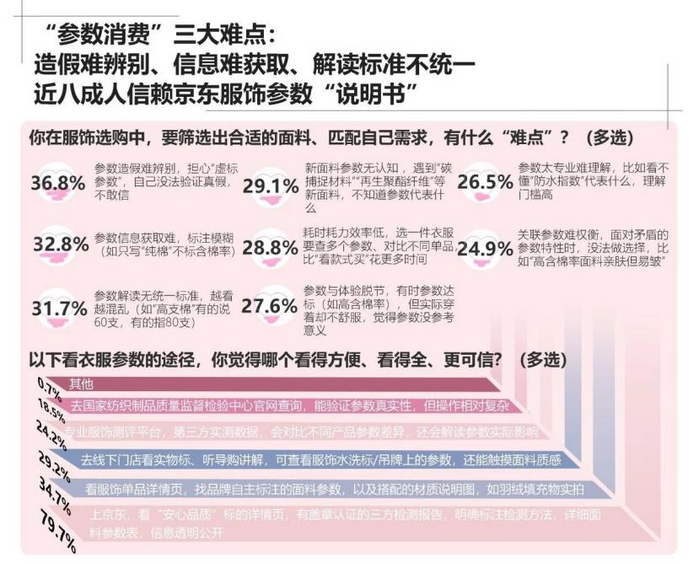

3. 消费趋势洞察:70%消费者关注面料材质和充绒量,提示研发高品质面料产品;电商平台推动价格竞争合理,服饰行业高速增长提供研发方向。

双11服饰市场提供大规模增长机会,京东平台为卖家提供可学习模式。

1. 增长市场和机会提示:京东整体增速27%,细分品类如保暖服饰增长258%,皮草、羽绒马甲等翻倍显示高需求细分。

2. 可学习点与应对措施:JD FASHION严选产品带动增长288%,卖家可加强产品品质把控,关注消费者硬指标偏好;超500家品牌3倍增长,提示促销活动参与策略。

3. 合作方式:京东甄选数万品牌,提供招商扶持,卖家可加入平台活动,利用数据反馈优化运营。

消费需求推动高质量生产需求,京东平台带数字化电商启示。

1. 产品生产和设计需求:消费者70%关注面料材质和充绒量,工厂需优先生产高品质面料产品;设计需注重百搭性和价格合理性,如JD FASHION强调的严选标准。

2. 商业机会:保暖类商品如羽绒服、棉家居服成交额翻倍,提供冬季服饰生产机会;超1000家品牌翻倍增长,显示品牌代工潜力。

3. 数字化电商启示:京东平台推动服饰销售高增长,工厂可探索电商渠道合作,京东数据反馈产品需求。

行业向品质化趋势发展,京东提供解决痛点方案。

1. 行业发展趋势:服饰线上销售高增长27%,JD FASHION频道带动成交额环比增长288%,显示平台导向品质。

2. 客户痛点和解决方案:消费者担忧品质问题,解决方案如京东严选面料保障JD FASHION产品;增长数据揭示服务可聚焦保暖细分需求,提供定制服务。

商业需求推动京东平台创新,招商和运营措施见效。

1. 商业对平台需求和平台做法:商家需增长渠道,京东上线JD FASHION严选产品,甄选品质面料和设计,满足80%消费者首选需求,带动服饰增长258%。

2. 平台招商和运营管理:吸引近2000个品牌成交翻倍,严选标准提升招商竞争力;运营中关注保暖等细分品类,翻倍增长提示精准管理。

3. 风险规避:京东数据监控消费偏好,如70%关注硬指标,平台可强化品质保障规避信任风险。

双11揭示电商服饰产业新动向,商业模式创新成功。

1. 产业新动向:服饰线上增速27%领跑,京东主导服装鞋靴增长;消费者80%首选平台显示渠道变化。

2. 新问题:70%关注品质指标如面料,提示产品信任问题;增长翻倍显示产业规模化趋势。

3. 商业模式启示:JD FASHION严选频道推动288%增长,严选标准为平台商业模式提供案例,建议关注数字化与品质结合。

返回默认