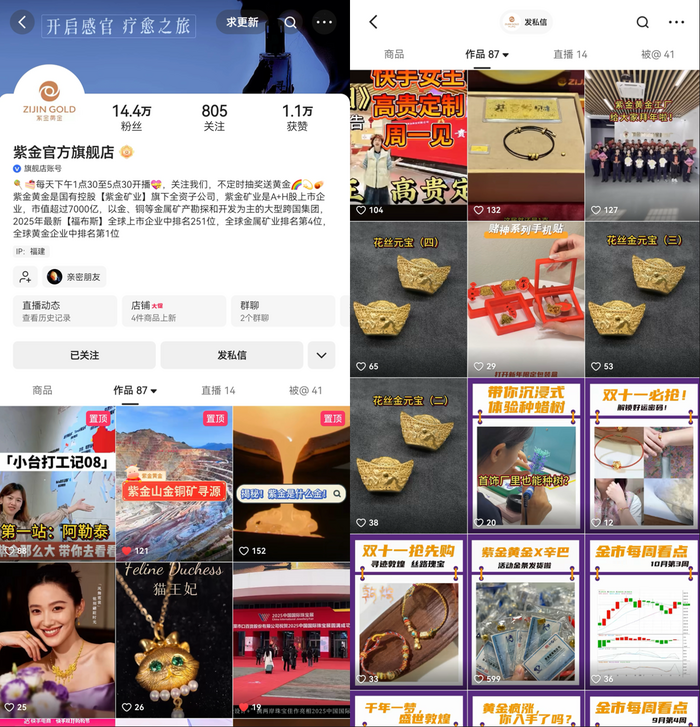

紫金黄金在快手平台通过自播达播联动策略实现销售突破,数据亮眼且实操干货丰富。

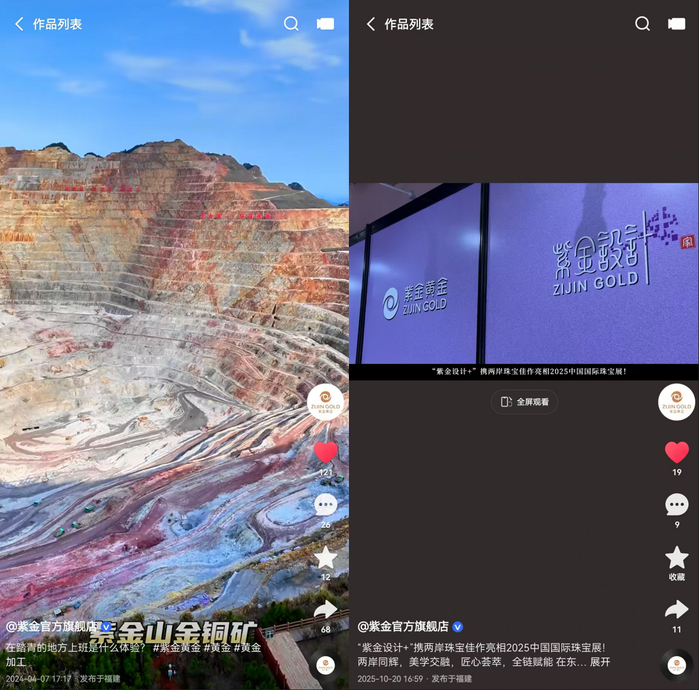

1.经营策略上,采用达人分销快速建立信任,如携手快手多层级达人以紫金矿业背景背书,之后品牌自播沉淀用户,展示矿山开采和冶炼加工环节提升可信度。

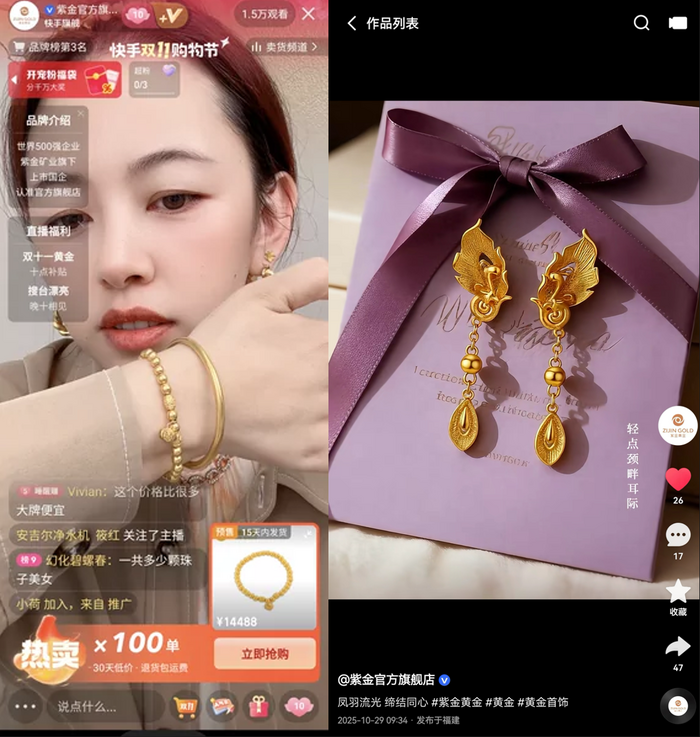

2.产品创新方面,主打差异化货盘,如含香金系列带有留香功能,奢宠系列针对宠物爱好者,降低克重和客单价改善传统痛点。

3.大促实战技巧包括提前半个月预热短视频(如金价趋势宣讲)、双轨货品策略(引流金条+高附加值产品),并配合头部达播与自播同步、直播时长延长至12小时。

数据支撑包括大促首日破亿GMV、直播间平均客单价6000元、黄金首饰复购率70%、单日粉丝增长超5000人。

紫金黄金的品牌营销和产品研发策略成功抓住消费趋势。

1.品牌渠道建设上,通过达人分销引爆声量(如借势达人粉丝群体),品牌自播沉淀高价值人群(30-40岁女性用户),形成种草到复购闭环。

2.产品研发针对消费趋势,如金价上涨导致的囤金热潮,开发含香金系列提升附加值、奢宠系列融入情感元素,总监张鹏指出用户画像为中高端女性群体。

3.品牌营销结合平台补贴,如双11期间利用快手20亿宠粉红包,差异化货盘精准承接需求,提升用户粘性。

4.价格竞争管理通过双轨货品实现,以低价引流品吸引流量,高价产品提升利润,同时新工艺(如含香技术)强化壁垒。

紫金黄金提供可学习的事件应对措施和增长机会。

1.事件应对措施上,双11金价波动引发囤金热潮,品牌提前预热短视频(如金价宣讲)、拉长直播时间覆盖活跃时段,利用平台流量扶持对冲风险。

2.消费需求层面机会包括细分市场挖掘,如奢宠系列针对养宠人群激情绪共鸣,差异化产品拉动70%复购率,张鹏分析用户需求后提供高低价段产品。

3.最新商业模式与合作方式采用达人分销+品牌自播联动,如与快手头部达人合作分销后自播间承接流量,平台招商扶持包括全场域流量加持,带来GMV破5亿佳绩。

4.机会提示和可学习点有双轨货品策略(引流品与高附加值品组合)、磁力金牛定向投放,提升人群转化效率。

紫金黄金的产品设计需求和电商启示值得关注。

1.产品生产方面,强调上游环节(如矿山开采)可视化增强用户信任,设计需求包括创新含香金系列专利工艺、奢宠系列降低克重适应佩戴体验,张鹏提到工艺源于重奢品牌启发。

2.商业机会上,电商平台热卖高附加值产品,如金饰复购率达70%,黄金投资属性强化,差异化货盘创造生意增量。

3.推进数字化启示包括自建直播间沉淀用户资产,快手平台助销占全平台30%份额,展示如何结合短视频与直播提升转化。

4.生产设计需求导向用户偏好,如开发含香金和宠物主题产品,配合平台补贴拉长直播时段,优化产销链路。

紫金黄金的案例揭示行业趋势和客户痛点解决方案。

1.行业发展趋势上,金价上涨推动囤金热潮,快手电商GMV超万亿提供增长空间,品牌计划深化全域布局触达多元人群圈层。

2.新技术应用包括差异化产品(如含香金专利)、磁力金牛投放工具,创新主播矩阵人设设计专家解读工艺价值。

3.客户痛点如黄金销售信任挑战,解决方案通过达人分销建立认知、自播间展示原矿生产环节强化可信度,高附加值产品缓解重决策焦虑。

4.行业痛点解决涉及用户需求洞察,张鹏指出偏好定制化设计,服务商可效仿以公私域协同激活高粘性流量。

紫金黄金的实践反映平台需求和最新做法。

1.商业对平台需求和问题包括信任建立难题,平台提供全场域流量扶持和20亿宠粉红包等补贴,张鹏强调快手生态用户粘性助力增长。

2.平台的最新做法如招商合作方式(达人分销+品牌自播联动),运营管理包括支持延长直播至12小时、短视频切片渗透。

3.平台招商方面,快手流量扶持帮品牌涨粉超2万,风向规避通过差异化货盘(引流金条)降低风险。

4.运营管理优化体现于用户补贴工具,配合大促节点如双11,GMV贡献占比达30%,平台招商潜力显著。

紫金黄金案例分析产业动向和商业模式启示。

1.产业新动向上,金价波动强化投资属性,快手电商平台助力品牌销售占全平台30%,张鹏指出黄金珠宝新型工艺趋势如含香金系列。

2.新问题包括用户决策障碍,政策法规建议启示是平台需加强信任机制(如展示原矿资质),法规上结合电商补贴规范。

3.商业模式创新采用达人分销引爆声量、品牌自播沉淀人群,构建闭环体系拉动70%复购率,提供公私域协同模板。

4.政策启示涉及用户行为观察(30-40岁女性为主),模式发展包括未来定制化设计和高附加值产品研发,深化全域布局策略。

返回默认