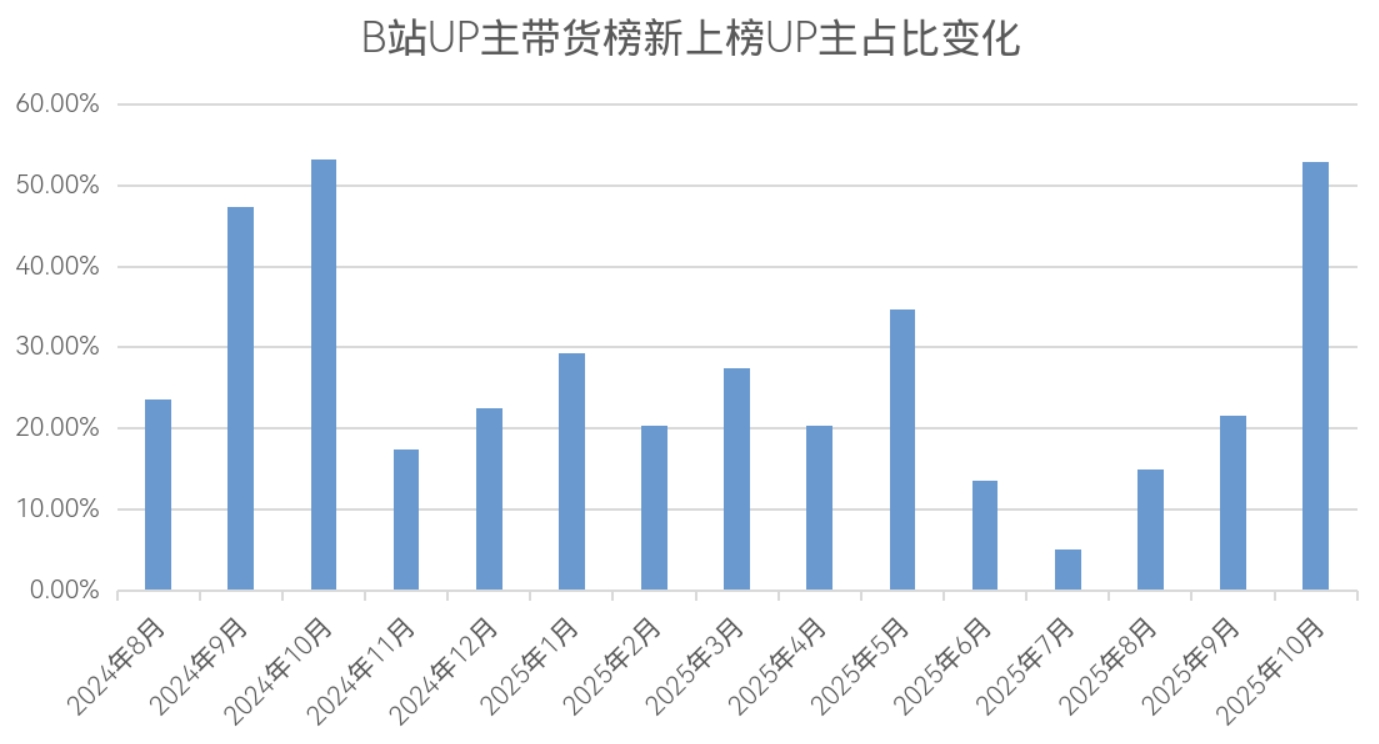

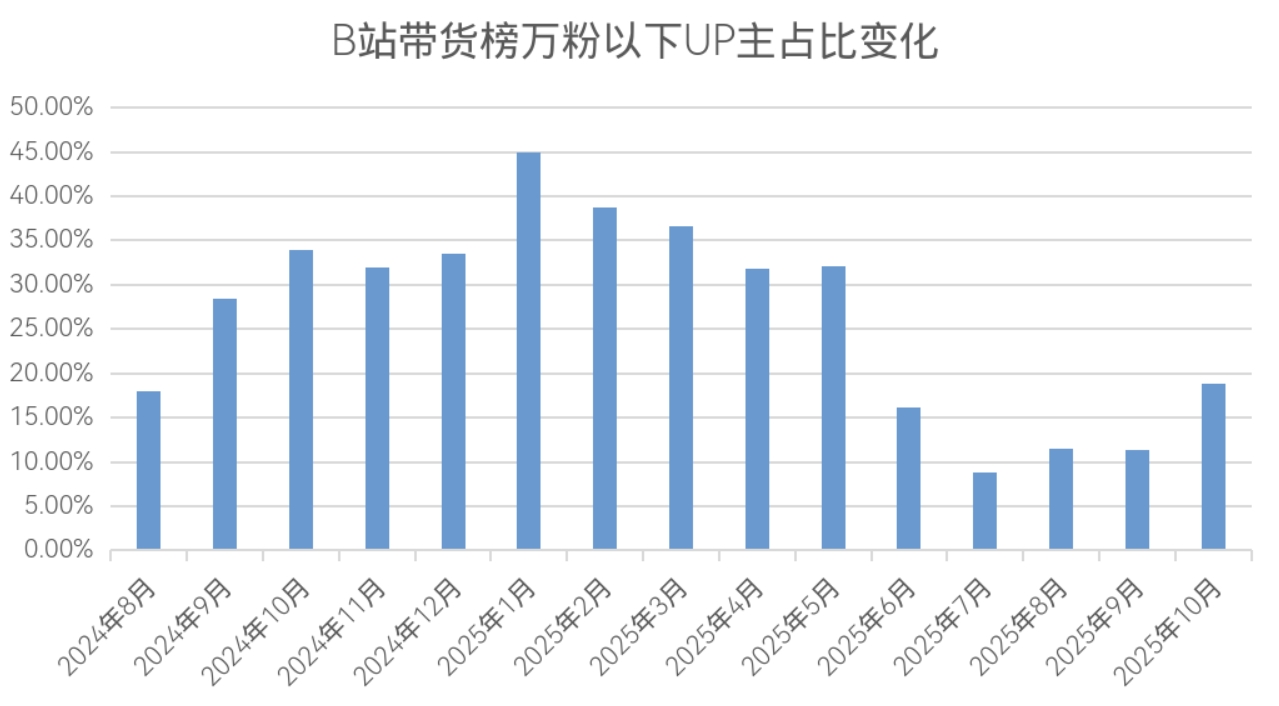

榜单概况核心数据:新人UP主占比高但GMV整体下滑。

1. 新上榜UP主占53.02%,同比下降52.41%,但占比与去年持平,其中万粉以下占新人群体75%。

2. GMV超百万UP主仅149名,同比减少52.24%;超千万UP主仅10名,同比减少80.39%。

结构和品类关键变化:UP主粉丝基础扩大且品类更丰富。

1. 万粉以下UP主占比降至18.79%,环比上升7.43个百分点;1万至50万粉丝UP主占比升至57.05%,平均粉丝数89.93万,同比增56.5%。

2. 带货品类多元化:科技区UP主占比降至55.7%,连续下降;服装配饰占比11.41%,成第二大品类,3C数码占比降至67.11%。

消费趋势和用户行为观察:用户需求转向多元化且关注中小UP主。

1. 服装配饰品类占比升至11.41%,跃居第二大,显示消费者对非科技产品兴趣增长,可研时尚新品以把握潮流。

2. 3C数码占比仍主导但下降,提示品牌需优化科技产品质量或定价策略以维持竞争力。

品牌营销机会:新人UP主占比高为低成本推广渠道。

1. 新上榜UP主超50%,尤其万粉以下占75%,品牌可合作这些新兴达人进行产品测试或小预算推广。

2. UP主平均粉丝数增长56.5%,但中小UP主占主流,提示强化影响力评估以精准选择合作对象。

风险提示和市场机会:整体GMV下滑但新人与品类提供增长点。

1. GMV同比降幅超50%,超千万UP主锐减80.39%,且超千万低粉丝UP主仅1名,显示依赖头部达人风险高。

2. 新上榜UP主占比53.02%,万粉以下居多,卖家可寻找新兴UP主合作,降低成本并测试新渠道。

消费需求和商业模式变化:服装品类崛起带来销售新路径。

1. 服装配饰占11.41%成第二大品类,显示用户需求多样化,卖家可拓展该品类或结合内容营销。

2. UP主粉丝结构变化,中小UP主增多,提供可学习合作模式,如与1-50万粉丝群体联盟提升带货粘性。

产品设计需求启示:品类分布变化需调整生产线。

1. 服装配饰占比11.41%成第二大品类,工厂可研发符合该趋势的时尚产品以满足用户新增需求。

2. 3C数码占比降至67.11%但仍高,工厂可优化该品类制造成本或功能设计以保持市场竞争力。

商业机会和数字化启示:UP主带货提供电商合作新途径。

1. 新UP主数量占比高,工厂可探索与中小UP主直接合作生产定制化产品。

2. 粉丝结构数据提示数字化渠道重要性,工厂可整合电商平台工具实现精准产销对接。

行业发展趋势:品类多样化和UP主结构变化带来新需求。

1. 科技区UP主占比持续下降至55.7%,非科技品类如服装配饰增长,服务商需扩展跨行业服务支持。

2. GMV整体下滑且超千万低粉丝UP主锐减,暴露客户痛点如UP主选择可靠性问题。

技术解决方案:数据分析工具可化解风险。

1. GMV同比降幅和粉丝结构变化数据,服务商可开发绩效监测工具,帮助客户筛选潜力UP主。

2. 新人UP主占比高但持效性低,服务商可提供匹配算法或培训方案提升客户ROI。

平台运营和招商动态:GMV下滑和新人多需管理优化。

1. GMV整体同比降幅超50%,低粉丝高产出UP主减少,平台需加强风控措施如算法反作弊机制。

2. 新上榜UP主占53.02%,平台可借此强化招商,推出扶持政策吸引品牌合作中小达人。

最新做法和需求管理:品类多元化为运营重点。

1. 服装配饰品类跃居第二,平台可调整频道运营和招商策略,优先该类别以吸引商家资源。

2. 平均粉丝数增长但环比下降21.49%,提示优化内容算法提升用户粘性和带货可持续性。

产业新动向和商业模式变化:带货格局演变暴露新问题。

1. 科技类UP主份额持续下降,服装品类增长至11.41%,显示消费多元化成为主流趋势。

2. GMV同比大幅下滑,超千万UP主减少80.39%,结合新UP主占比高但低产出锐减,提出可持续商业模式挑战。

政策法规建议启示:需强化UP主真实性监管。

1. 低粉丝高GMVUP主从15个降至1个,提示刷单风险,研究可建议平台引入数据审计制度确保公平竞争。

2. UP主结构数据如1-50万粉丝群体扩大至57.05%,可探索新合作模型如激励机制提升中小达人稳定性。

返回默认