TikTok Shop美区电商业务稳步增长,5月出现月销售额破千万美元的小店,保健品类目表现突出,提供实用市场洞察。

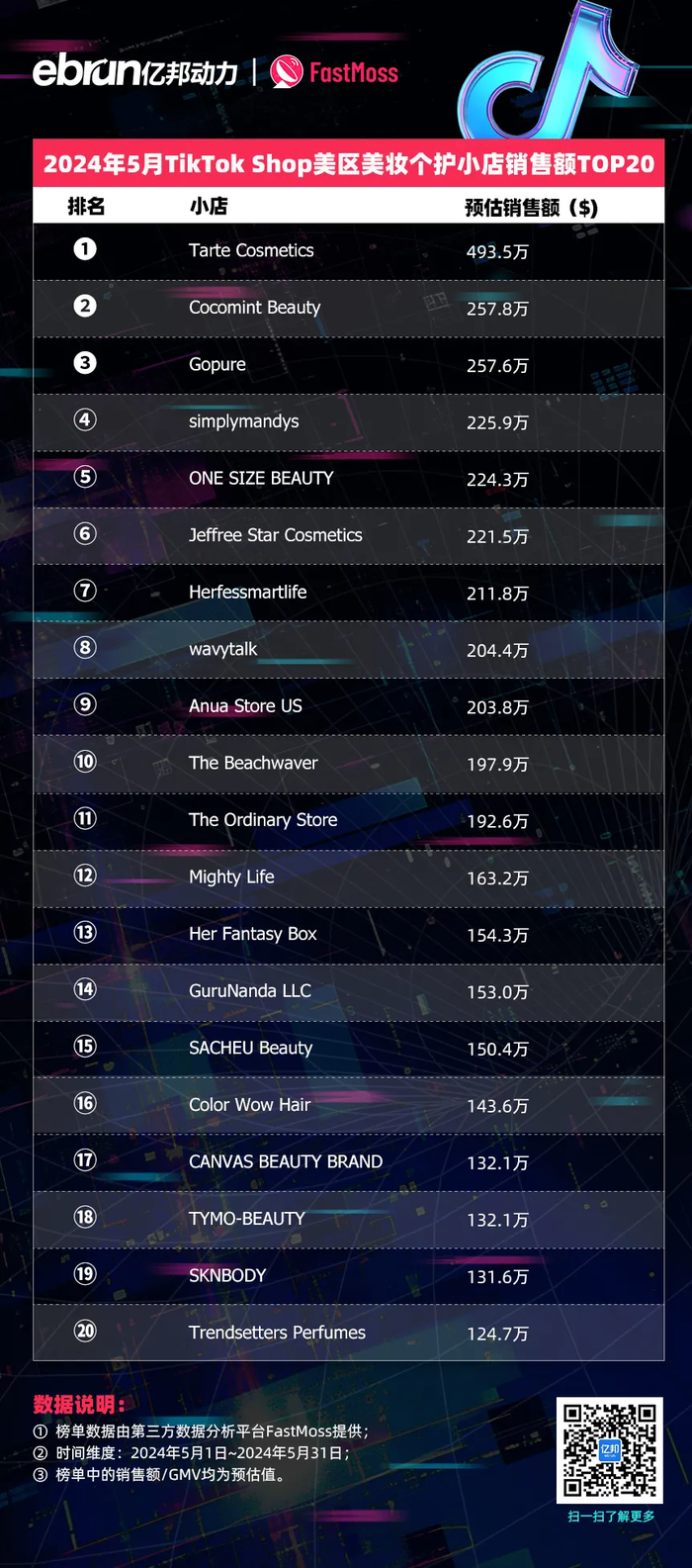

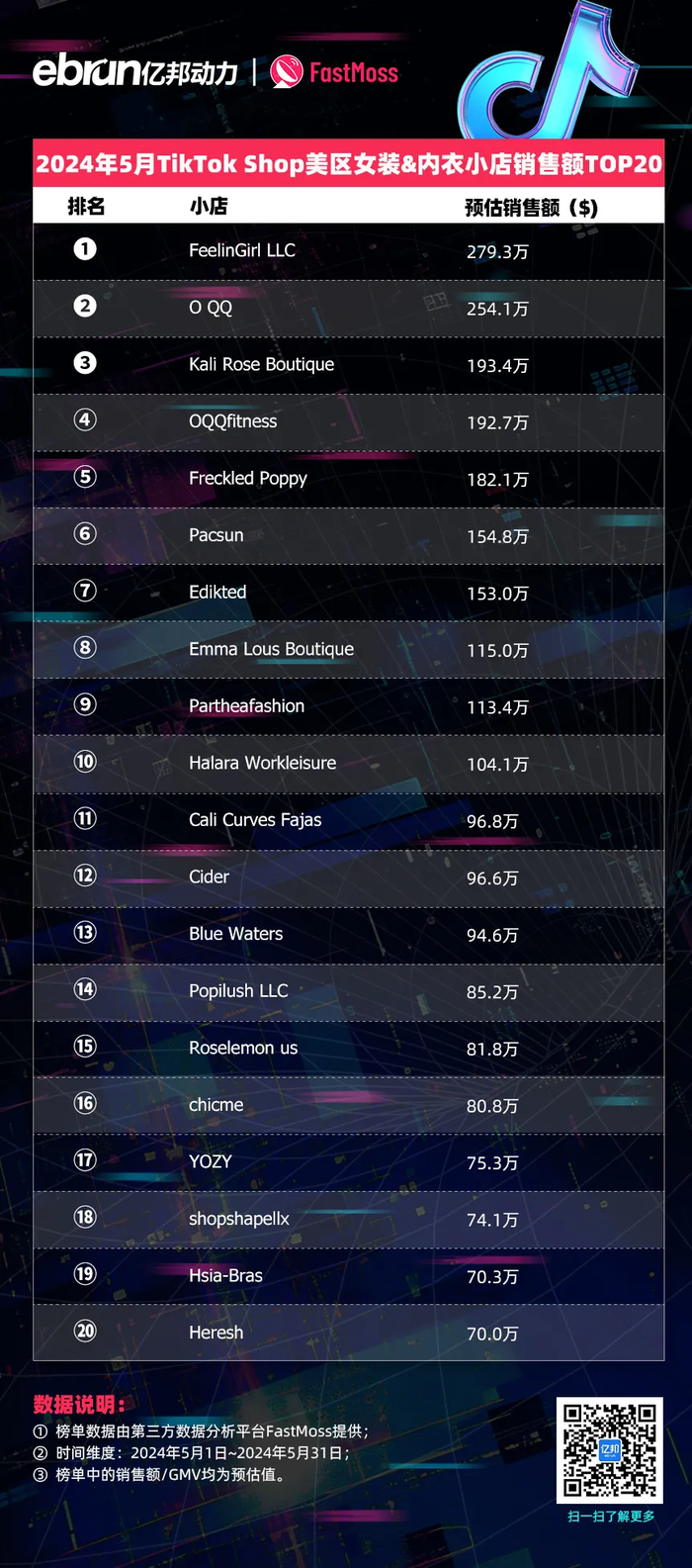

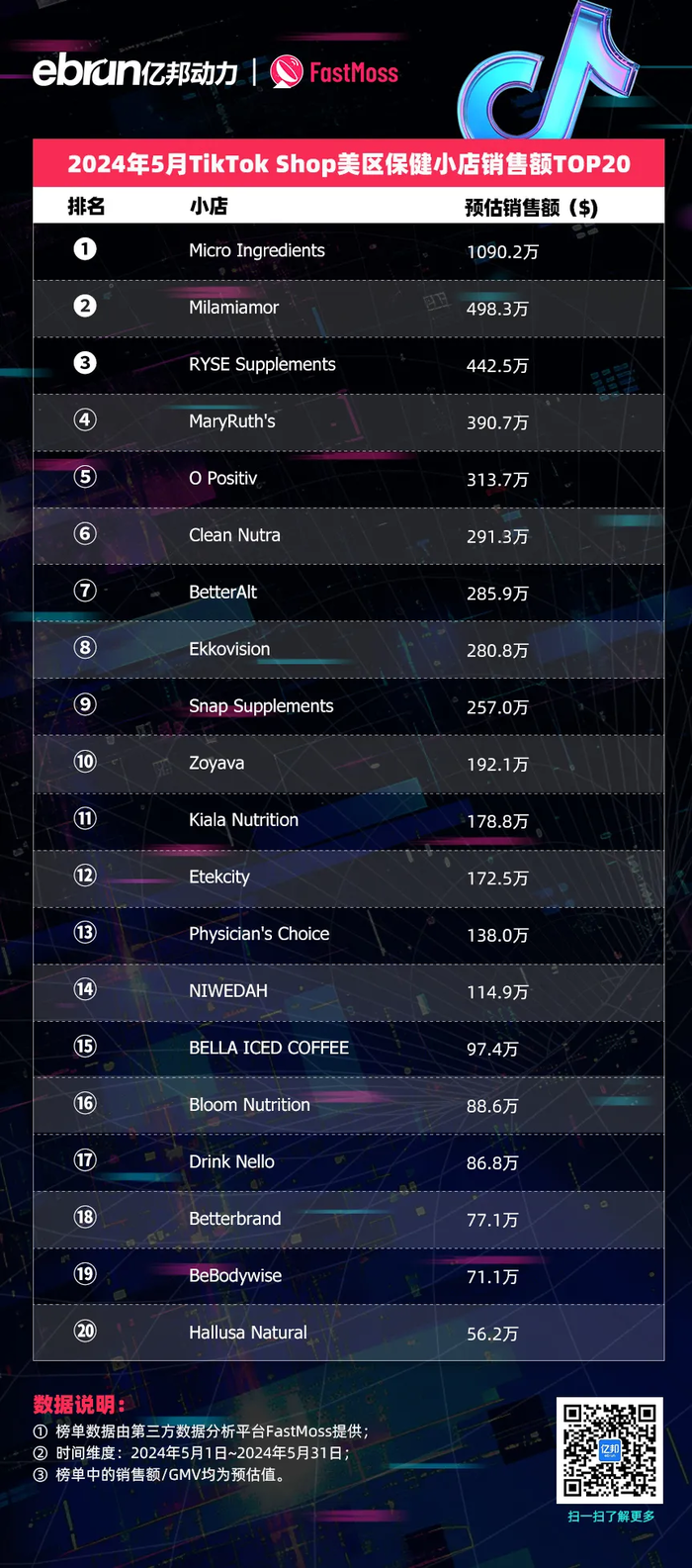

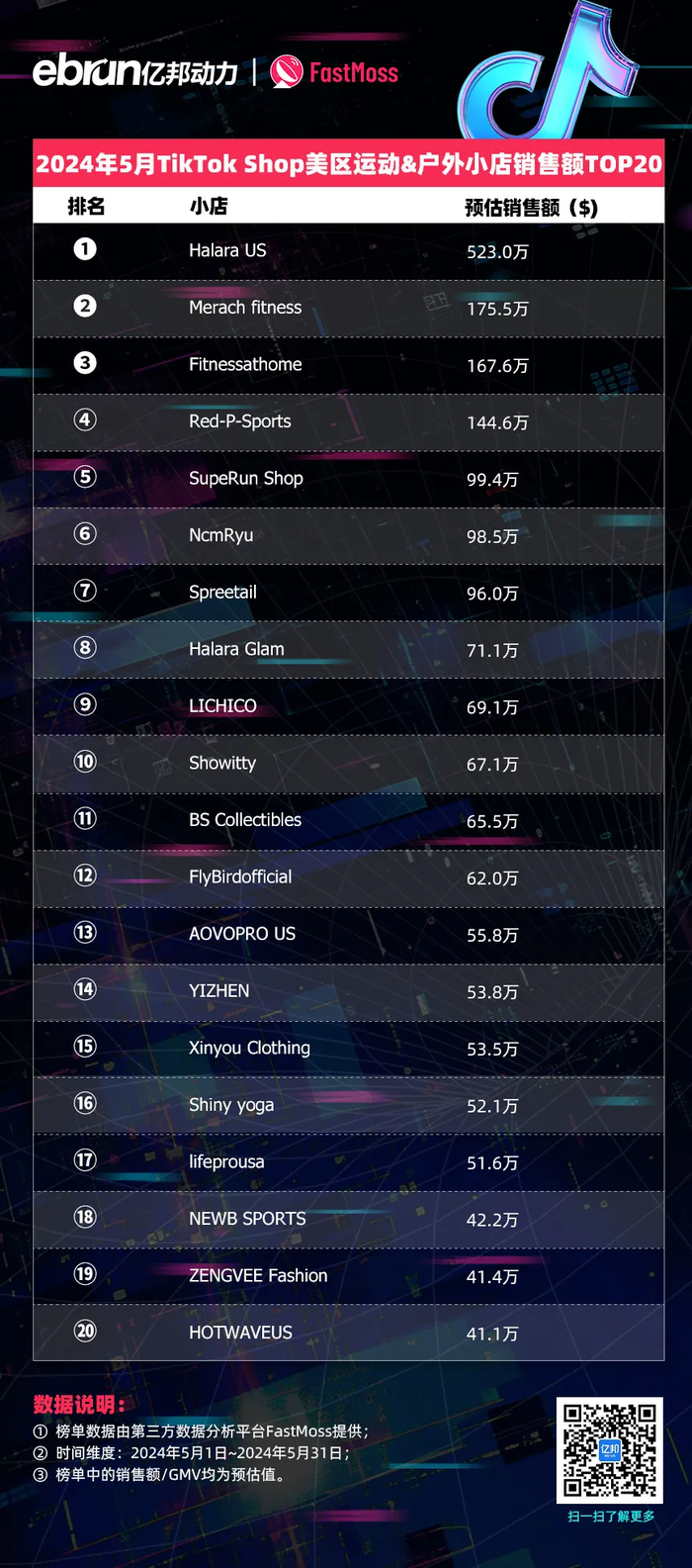

1. 小店销售额Top20中,Micro Ingredients(保健)以1090.2万美元领先,Halara US(运动)523万美元,Sweet Furniture(家具)515.9万美元;保健品类占9席,美妆个护占3席,显示品类热点。

2. 热销品类Top5依次为美妆个护(占比20.55%)、女装内衣(11.46%)、保健(9.59%)、收藏品、运动户外,帮助把握消费趋势。

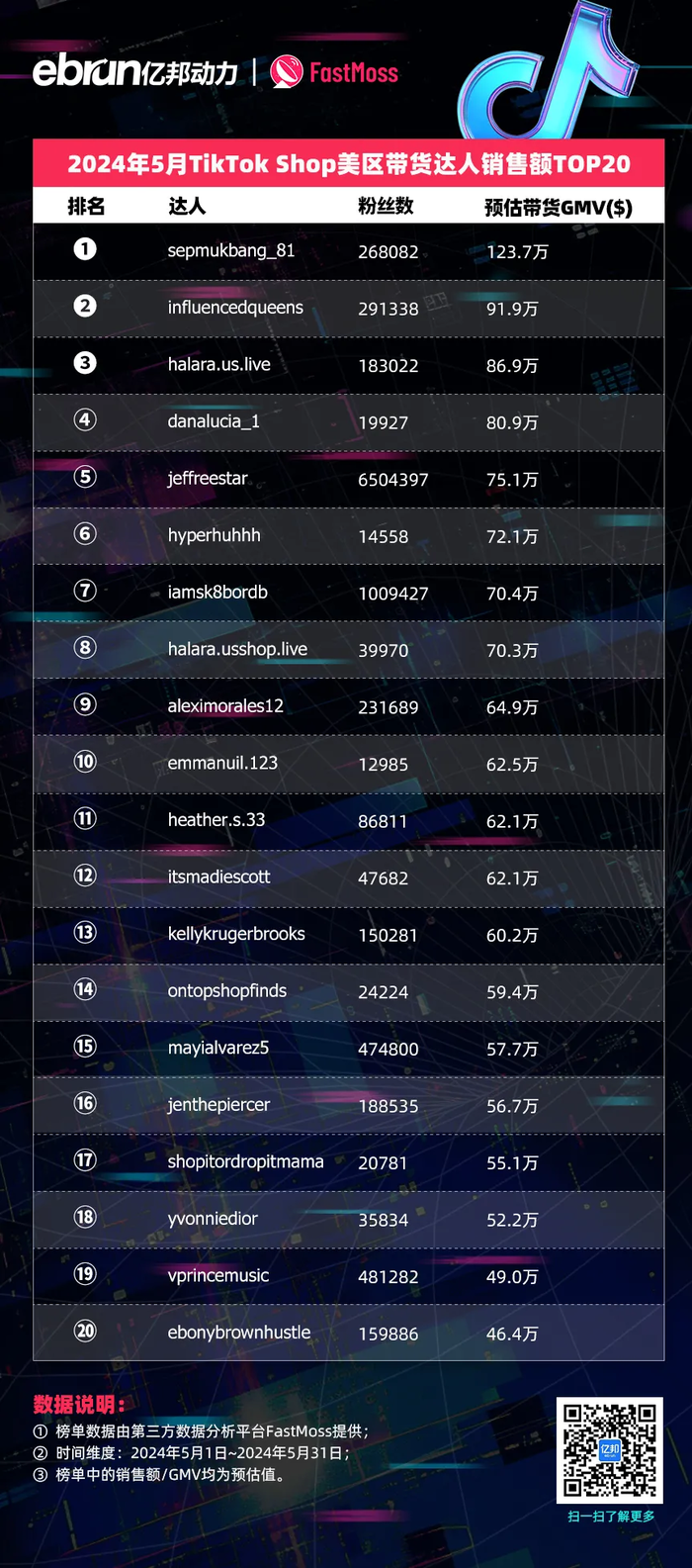

3. 带货达人Top20中,sepmukbang_81以123.7万美元月销第一,粉丝仅26.8万;18位达人月销超50万美元,如influencedqueens(91.9万美元)和halara.us.live(86.9万美元),提供影响者营销参考。

保健品类目需求激增,品牌可借机优化营销和研发,聚焦消费趋势和用户行为。

1. 品牌营销机会:保健品类异军突起,Micro Ingredients月销1090.2万美元,显示健康产品潜力;美妆个护类Tarte Cosmetics月销493.5万美元,女装内衣FeelinGirl LLC月销279.3万美元,提供成功品牌案例。

2. 消费趋势和用户行为:Top5品类中保健占比9.59%,达人带货如sepmukbang_81月销123.7万美元,表明影响者渠道有效;用户偏好健康、个护产品,品牌可研发相关新品。

3. 品牌渠道建设:小店如Halara US在运动户外月销523万美元,展示TikTok平台渠道价值;合作达人可提升曝光,如粉丝超650万的jeffreestar月销75.1万美元。

TikTok Shop美区市场增长显著,提供保健等品类机会,但需注意竞争风险,学习成功案例。

1. 增长市场和机会提示:平台GMV目标扩大10倍,5月小店Micro Ingredients月销超千万美元;保健品类14家小店月销超百万,美妆个护Top20均超百万,显示高需求领域。

2. 消费需求变化和可学习点:保健品类异军突起占Top20九席,卖家可借鉴Micro Ingredients策略;达人带货模式有效,sepmukbang_81低粉丝高销售额(123.7万美元),提供营销模板。

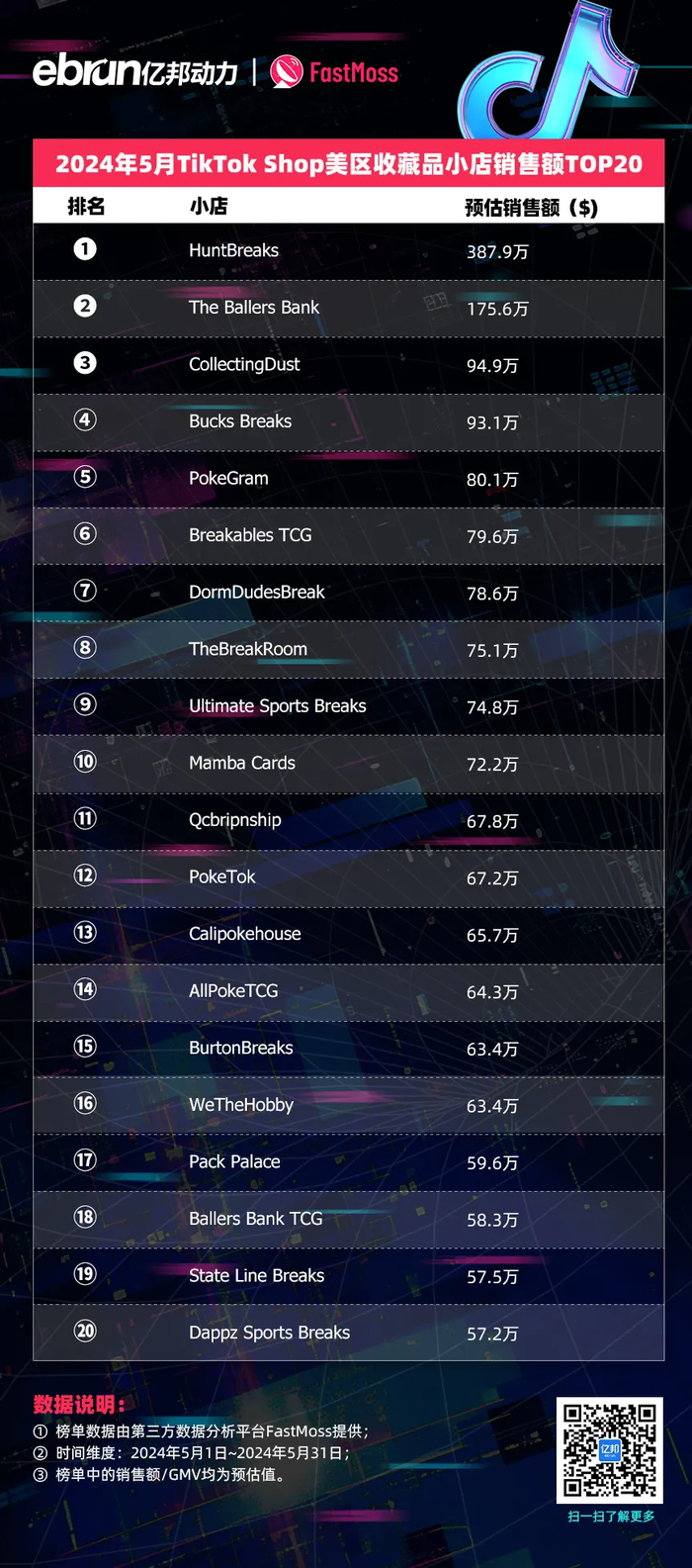

3. 风险提示和事件应对:竞争激烈,如收藏品类Top小店HuntBreaks月销387.9万美元,但后续销售额骤降;数据非官方或有偏差,卖家需验证信息规避风险。

保健产品需求高涨,工厂可聚焦生产和设计,利用电商渠道拓展商机。

1. 产品生产和设计需求:保健品类目表现突出,Micro Ingredients月销1090.2万美元,RYSE Supplements月销442.5万美元,显示健康产品强需求;工厂可研发相关新品如补充剂。

2. 商业机会:运动户外类Halara US月销523万美元,家具类Sweet Furniture月销515.9万美元,提供多元化生产方向;Top品类如美妆个护需求稳定,工厂可合作小店供货。

3. 推进数字化和电商启示:通过TikTok平台销售,参考Top小店案例;数字化工具如FastMoss数据监测,帮助优化生产计划,提升电商效率。

行业趋势显示TikTok电商增长,服务商可提供数据洞察解决客户痛点,优化销售策略。

1. 行业发展趋势:TikTok Shop美区稳步扩张,保健品类崛起占热销Top3;平台GMV目标扩大10倍,显示长期增长潜力,服务商可把握机遇。

2. 客户痛点和解决方案:商家需准确数据监测表现,如FastMoss提供非官方榜单;痛点包括竞争分析和品类优化,解决方案如利用数据工具识别热销品类(美妆个护占比20.55%)和达人带货效果。

3. 技术应用:数据监测服务帮助客户分析小店销售额(如Micro Ingredients超千万美元)和达人GMV(sepmukbang_81 123.7万美元),提供定制报告提升决策。

平台需求旺盛,需加强招商和运营管理,规避数据风险,支持商家增长。

1. 商业对平台的需求和问题:商家对TikTok Shop兴趣高,热销品类如保健需求大;问题包括数据准确性(榜单非官方或有偏差),平台需提供可靠工具。

2. 平台的最新做法和招商:发布销售额榜单激励入驻,如保健品类Micro Ingredients成功案例;招商机会在Top品类如美妆个护、运动户外,吸引更多小店。

3. 运营管理和风向规避:管理达人带货,如sepmukbang_81高销售额;规避风险如确保数据透明,避免误导商家;扶持政策可参考榜单,优化平台规则。

产业新动向包括TikTok电商扩张和保健品类增长,引发新问题如消费趋势变化,提供商业模式启示。

1. 产业新动向和新问题:TikTok Shop美区GMV目标扩大10倍,5月数据稳健;新问题:保健品类为何异军突起?可能用户健康意识提升,需研究消费行为。

2. 商业模式分析:达人带货模式成功,sepmukbang_81粉丝26.8万月销123.7万美元;小店如Micro Ingredients月销超千万美元,展示电商新形态。

3. 政策法规建议和启示:平台数据非官方,建议加强透明度;产业启示:关注品类占比(如保健9.59%),为政策制定提供依据,支持可持续增长。

返回默认